Financial strategies start with picking the right budgeting methods that line up with your organisation’s goals. Because no one wants to drive in the dark or swim in murky water.

While this topic rarely sparks any excitement, budgeting is a strategic tool that every business needs to nail. For this reason, many strive to look for the “best match” for their team and company.

Fun fact: TRG can name at least five different techniques for budgeting, but in this article, we will look at only two. Are you ready to level up your organisation’s budgets?

Why do companies even need to have a budget?

We all know the importance of having a budget, both in our personal and corporate lives. Budgets in all shapes and sizes serve as the financial roadmap, outlining the spending limits that the business can afford. More importantly, this financial roadmap empowers leaders to make informed, evidence-based decisions by assessing the financial implications of their choices

Read more:Budgeting Takes Too Long? Vital Signs You Need A Dedicated Solution

Additionally, having clearly defined budgets gives businesses:

– Financial control and clarity: In other words, a clear picture of the company’s financial situation by tracking where money is coming from and where it is going to avoid overspending.

– Insights for goal setting and strategic planning: With a clear financial picture painted by the budgets, businesses can align their spending with the overall targets, such as new market expansions, new product development, or recruitment.

– A baseline to allocate resources: A budget helps a company allocate its resources more effectively, allowing managers to prioritise initiatives and ensuring every dollar is put to its best use.

– Metrics to evaluate performance: Budget numbers can act as a benchmark or can be used to compare actual results to budgeted projections, thus identifying risks as well as areas where the company is performing well and where it needs to improve.

– Opportunities to secure funding: A well-structured budget can “show off” the company’s financial responsibility to attract potential investors.

There are many different methods and approaches to budgeting. In this article, TRG will only touch base on incremental and zero-based budgeting. For a deeper dive into other budgeting techniques, check out our other articles:

5 Most Common Budgeting Approaches and Their Pros & Cons

Budgeting: From Manual to Agile

Looking Beyond the Fiscal Year: How to Transition to Strategic Budgeting

How to Budget: A Step-by-Step Guide to Developing & Managing a Budget

Incremental and zero-based budgeting – What do they mean?

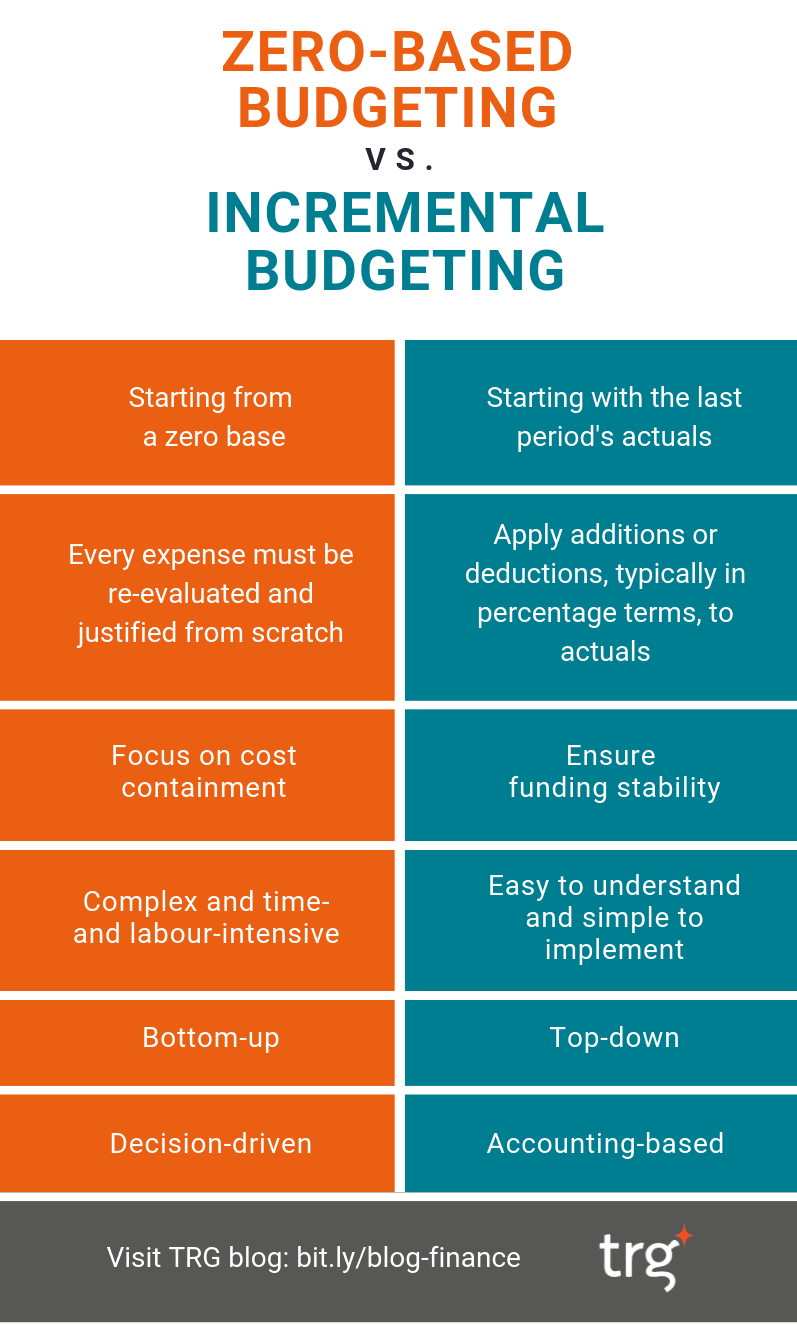

These methods differ fundamentally in their starting points. They stand at opposite ends of the spectrum: one lets you build on existing budgets, the other allows you to start fresh with a clean canvas.

A clear understanding of these differences helps you choose the right method that fits your business’ needs.

Incremental budgeting

The incremental budgeting method relies on adjusting last year’s budget to predict the current year’s financial needs. In other words, your budget for this year will be the template or the basis for your upcoming financial year. All assumptions will remain the same or somewhat similar. Adjustments will be made only in areas that are predicted to change.

Incremental budgeting shines because it is simple to operate. Organisations can understand and implement this approach with minimal prep time and lower costs. The method helps maintain stable and predictable financial plans while also reducing tension within the organisation by treating all departments the same way.

For example, Company A spent $100,000 on marketing last year, and they would use this number as the basis for setting next year’s budget. If company A plans to launch a big marketing campaign and expects costs to rise by 10%, they would simply increase the marketing budget to $110,000. Or the team might suspect that the advertising costs will likely go up in the coming period, so it will make sure to include that in the budget.

Read more:How to Build a Budget Management Culture: A Step-by-Step Guide for Managers

In short, incremental budgeting:

– Simple, straightforward, and predictable

– Relies on historical metrics and past lessons for adjustments

– Requires decision-makers to carefully evaluate all planned activities and their costs

– All departments get the same percentage increase

As simple as that!

But that is the good stuff; the not-so-good side of this method is that it encourages wasteful spending and inefficiency, as the method only considers changes from the previous period while ignoring external factors, and teams tend to have a fixed percentage share over time. Past budgets and actual performance are the foundations of incremental budgeting. If there is a major disruption to the market, the company might not have enough funds or the flexibility to accommodate emergencies.

Moreover, it is also susceptible to overspending and manipulation. A department might overestimate its numbers to appear like it is “saving money for the company” or out of fear that if it does not use up all its budget by the cutoff date, the team might be allocated fewer resources next time. This makes the gap between budgets and actual results grow bigger over time.

Zero-Based Budgeting (ZBB)

Zero-based budgeting got its name from its practice, which is starting the company’s budget at ground zero every time, i.e., literally beginning from scratch. With this approach, each department will need to look at its activities, plans, targets, etc., and build the budget based on those proposed events. Managers cannot assume any spending will continue without new approval.

So far, ZBB is not so much different from incremental budgeting, right? However, there is a twist. Each line item must be tied to a purpose or a clear requirement. For instance:

– Description of the activity and justification

– Statement of objectives and expected benefits

– Cost and time estimates, among other evaluation metrics

– Alternative methods to achieve the same outcomes

– Resource requirements and risk considerations

Let’s continue with our Company A example. Their marketing department uses the zero-based budgeting method, so the Marketing Manager will not simply just take last year’s $100,000 budget and add 10% to create a new budget and call it a day.

Instead, they need to present a detailed plan for every dollar. They have to justify spending $5,000 on social media ads by showing the expected customer acquisition rate. Wanting to spend an extra $5,000 on subscription services for new tools like the new AI chatbot or marketing dashboards? Well, they need to justify it! The same goes for the $10,000 spent on a specific trade show last year; how was the result? Was it still worth it this year?

Read more:Looking Beyond the Fiscal Year: How to Transition to Strategic Budgeting

By applying ZBB and questioning every expense from the ground up, the company ensures that budgets are:

– More accurate; every dollar spent is intentional and supports a clear business objective

– More adaptive, as they reflect market conditions rather than something that has already happened in the past

– More cost-efficient and lean, as the approach encourages managers to align every number with a purpose, thus eliminating wasteful spending or “bloating” the budgets.

– More strategic, as resources can be better allocated to the most important and value-adding activities.

ZBB definitely has its drawbacks, too. First and foremost, it is very resource-intensive, requiring significant time, effort, and skills to carry out. Large organisations can struggle as they may create excess paperwork during the process, not to mention internal conflicts as different teams might compete for the needed funds. ZBB can also make organisations overlook long-term projects, like research and development, as they do not always yield immediate, quantifiable results.

Incremental vs zero-based budgeting: A brief comparison

Which one should your business choose?

The choice between zero-based and incremental budgeting, or any other budgeting method, ended up being more about what organisations need rather than picking an outright winner.

Each method works well in specific business situations. Incremental budgeting keeps things simple and stable, perfect for companies that have been around a while and know their costs. On the other hand, zero-based budgeting gives better cost control by taking a hard look at expenses and arranging them with company priorities.

Read more:How to Build a Budget Management Culture: A Step-by-Step Guide for Managers

Many businesses today adopt a hybrid approach (or a mix of different techniques) to better cope with the market’s unpredictability. Combining incremental and ZBB budgeting methods can look something like this:

– Companies use incremental budgeting for the day-to-day operations

– Refresh their views on the process every 3-5 years with zero-based budgeting to incorporate new conditions, activities, demands, etc.

Even companies that mainly use incremental budgeting sometimes turn to zero-based budgeting in tougher economic times, as it is a useful way to identify saving opportunities and boost efficiency when it matters most. At the end of the day, the quickest way to budget is not about which method saves more money but about which one best fits a company’s needs, limits, and goals.

Want to transform your manual budgeting process into a more agile one? Check out our on-demand webinar to learn how!