You have likely seen an invoice before. Have you ever wondered what happens to it after submitting it to Finance? The journey of an invoice is more complex than it might initially appear. Before the invoice gets paid, the Finance team, or specifically the Accounts Payable (AP) specialist, has to go through dedicated workflows, which involve multiple steps, one of which is purchase order matching.

This matching process has more than one way to do it, each tailored to different scenarios and requirements.

Purchase Order (PO) matching is a critical process in accounts payable and procurement that involves comparing and validating different documents related to a purchase to ensure accuracy and prevent errors or fraud before payment is made to a vendor.

The primary goal of PO matching is to ensure that a company pays only for the goods or services it ordered at the agreed-upon price and that they were actually received.

Read more:Top Common Accounts Payable Automation Myths Debunked

Types of PO matching

Purchase order matching serves as a vital verification process in accounts payable workflows. Different matching levels give you various degrees of financial control and protect against errors and fraud. Each method builds on the previous one and adds security layers to ensure accurate payments are made to the right vendors at the right time.

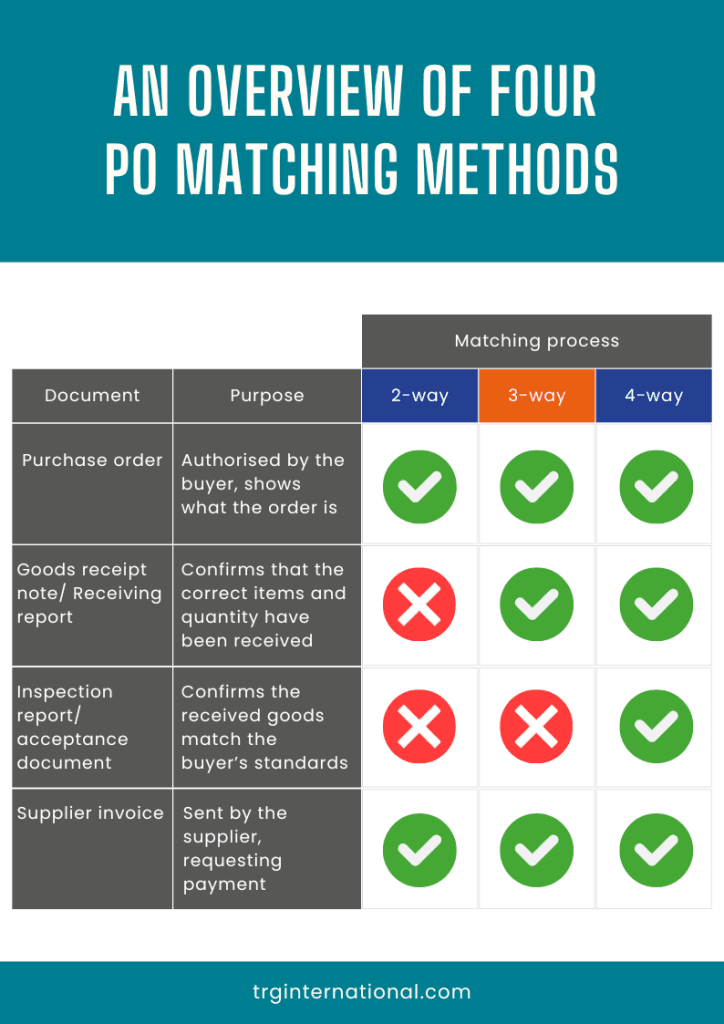

Let’s explore deeper into the most common types of PO matching: two-way, three-way, and four-way matching.

1. Two-way matching

Two-way matching, also called invoice matching, is the simplest form of purchase order matching. The method looks at two main documents:

– The purchase order (PO): The initial document created by the buyer detailing what was ordered, the quantity, and the agreed-upon price.

– And the supplier’s invoice: The bill sent by the supplier requesting payment for the goods or services delivered.

This direct approach ensures that what the business ordered matches the bill by checking quantities, prices, and terms on both documents.

Read more:7 Worst Financial Fiascos Caused by Excel Errors

How the process works:

– The company gets an invoice from a vendor for goods or services ordered via the purchase order.

– The AP team checks if the description, quantity, unit price, total amount, etc., stated on the invoice match the corresponding details on the purchase order.

– The AP team inputs those details into their system (spreadsheets, accounting software, ERP systems, etc.).

– The invoice gets approved and paid if all details match within the allowed limits.

Any mismatches put the invoice on hold until someone fixes the issue.

| Pros | Cons |

| – Simple process – Fewer documents – Less manual effort – Lower operational costs – Quicker payments | – No verification can increase risks and errors – Lack of control over receipts – Limited audit trail |

Two-way matching is effective for routine, low risk purchases that do not need delivery confirmation. However, this method does not prove that ordered items arrived or met quality standards.

2. Three-way matching

Three-way matching is the most widely adopted and recommended method for most businesses. It adds another security layer by bringing in a third document: the goods receipt note (GRN) or receiving report. This method ensures the invoice matches the purchase order and confirms that someone received the goods or services in the right amount.

The AP department compares the details (items, quantities, and prices) across all three documents. For an invoice to be approved, the information on the PO, invoice, and receiving report must match within acceptable limits.

Read more:Comparing Top Accounts Payable Automation Solutions

The AP team needs to check all details across three documents:

– Purchase order: The purchase order has complete and correct information, with payment amount and vendor details.

– Goods receipt note: The quantity ordered matches what arrived and was received by the company.

– Supplier’s invoice: States what the supplier was billing for.

Three-way PO matching helps the AP team catch errors in invoices, thus minimising the risk of paying for missing items while creating better audit trails.

| Pros | Cons |

| – Reduced risks of overpayments, duplicate payments, or payments for unreceived goods – Stronger verification to prevent fraud – More reliable record of purchases and receipts – Better inventory management – Complete documents for auditing purposes | – Increased complexity as more documents are involved – Longer processing time, as there is an additional verification step – Higher administrative costs, if not automated – Potential discrepancies if done manually |

The three-way matching method suits most goods-based purchases where delivery verification matters. Still, it will not catch quality issues with items the company receive.

3. Four-way matching

Four-way matching takes verification further by adding a fourth layer—an inspection report. This detailed approach is typically used for high-value purchases and is built upon the three-way matching. It looks at four key documents: purchase order, receiving report, inspection report, and supplier invoice.

Read more: Powering the Future of Procure-to-Pay: TRG Teams Up with Yooz

The inspection report (inspection slip or acceptance document) details how the received goods passed quality checks and whether they meet specific standards or specifications. Receiving staff look for any damage or defects in shipments before creating this document.

All four documents must align in terms of item description, quantity, price, and quality/specifications before the invoice is approved for payment.

Four-way matching provides the highest protection against payment errors. However, it also requires the most resources and teamwork between procurement, receiving, quality control, and finance teams. It takes the most effort of all matching methods, making it best for purchases that need extra attention.

| Pros | Cons |

| – Maximum control and risk mitigation – Enhanced quality assurance following the company/ industry’s specifications (e.g., manufacturing, pharmaceuticals, aerospace, etc.) – Highest fraud prevention and clear audit trails due to exhaustive verification | – Highly complex and resource-intensive – Longest processing time, thus potentially leading to missed early payment discount opportunities or strained vendor relationships – Likelihood of increased discrepancies if done manually, as more processes are involved – Not suitable for routine or low-value purchases |

Each matching approach offers better security and accuracy, but so does the complexity. While two-way matching offers speed, it sacrifices control. Three-way matching strikes a balance between efficiency and control, making it a popular choice, while four-way matching provides the most robust control but comes with significant overhead, making it suitable only for specific, high-risk scenarios.

Deciding which method to adopt depends significantly on your business needs, transaction size, risk level, and industry requirements.

An overview of all four PO matching methods

Why is PO matching important?

PO matching shapes broader financial management. The process arranges procurement with invoicing and strengthens financial reporting. On top of that, it creates a clear paper trail that prepares organisations for audits and compliance checks.

Accurate PO matching serves many vital functions:

– Proving invoiced amounts match authorised purchase orders

– Spotting mismatches in documents that might point to price manipulation or fake invoices

– Clear and accurate matching builds positive vendor relationships through transparency

– Better matching processes free up valuable resources

– Reducing approval and processing time when automated

In the past, PO matching was a manual, time-consuming process. However, it has become harder as businesses process increasingly more transactions daily, which could lead to overpayment, missed discounts, fraud, and other financial losses.

The average loss reached $133,000/ £104,000 per incident in the last year alone. Perhaps the most disturbing fact is that 53% of finance professionals confessed to having experienced deepfake scams, and 47% of them have fallen victim to such an attack. [1]

According to British multinational universal bank Barclays, 20% of finance professionals are unaware or unable to estimate the cost of invoice fraud to their business. [2]

Read more: You’re Losing Money on Manual Invoice Processing! Here’s A Solution

Today, advanced tech like automation, OCR (Optical Character Recognition), and AI have provided companies with more options to automate their PO matching processes to improve efficiency, accuracy, and fraud detection.

Nevertheless, setting up systematic matching procedures—manual or automated—is not just good practice. It is a basic business need.

Benefits of automating PO matching in AP processes

The PO matching process can be significantly automated. In modern accounts payable workflows, automation is becoming the standard rather than the exception, providing immense advantages beyond simply reducing manual labour.

Improved accuracy and reduced human error

Manual invoice processing is notoriously known for creating costly mistakes that impact the accuracy of financial reporting. Businesses not only lose money to fix each document error but may also risk straining relationships with strategic partners and vendors.

Even the most skilled AP professionals can still lose their minds over mundane data entry and cause a bunch of basic errors on a bad day, let alone having to handle high invoice volumes day in and day out.

Automation systems meticulously compare invoices against purchase orders and receiving reports, thus minimising discrepancies in quantities, prices, and product specifications. The methodical verification ensures only accurate and valid invoices move to payment and reduces duplicate payments and incorrect entries.

Read more:How to protect your data when employees leave

Faster invoice approvals and payment cycles

Invoice matching automation speeds up the entire AP cycle by eliminating manual bottlenecks. On average, a single invoice can take anywhere from 8 to 15 minutes to process by hand, depending on its complexity. Multiply that time by hundreds or thousands of invoices monthly; an AP specialist can easily lose not just a couple of hours but many days in a row.

Automated invoice processing significantly accelerates accounts payable workflows, reducing processing times to just over 3 days while also lowering costs and increasing efficiency. [3]

Read more:Solving 5 Common Accounts Payable Issues with Automation

This improvement comes from efficient processes that route exceptions to appropriate personnel based on preset rules.

The benefits strengthen vendor relationships and improve cash flow management while maintaining optimal working capital positions.

Cost savings

Automation ensures that only correct invoices are paid, preventing overpayments and duplicate payments, which helps eliminate unnecessary fees, such as late payment penalties, as well as costs associated with manual processes like paper handling, printing, and storage.

The AP team can gain real-time visibility into invoice status and liabilities while staying on top of budgets, ensuring all spending aligns with approved purchase orders.

Additionally, the automated check makes it harder for doctored invoices or unauthorised purchases to slip through, thus saving both the reputation and bottom line of the business.

Many of today’s AP automation solutions are designed to scale with the business, enabling them to handle increasingly larger invoice volumes without the need for adding extra staff, thereby saving on overhead costs.

In short, automating PO matching transforms a labour-intensive, error-prone process into an efficient, accurate, and secure operation, delivering substantial strategic and financial benefits to organisations regardless of size and industry.

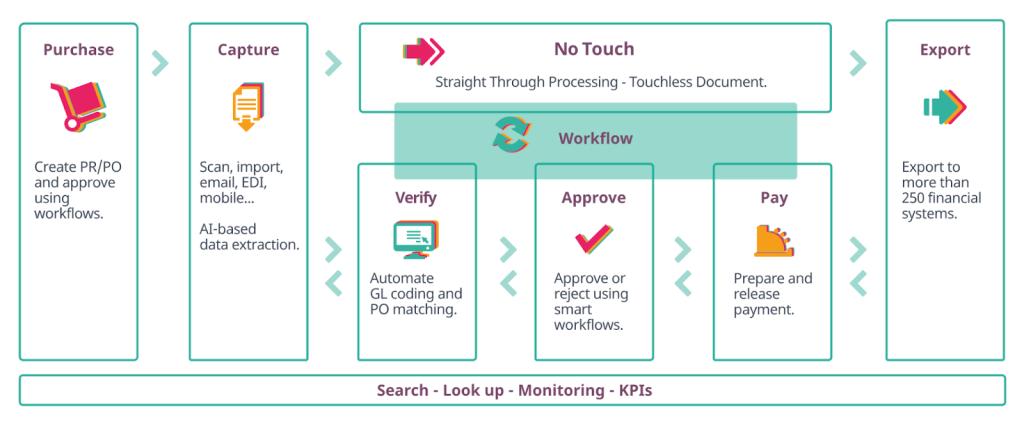

How PO matching automation works

Automation of PO matching primarily relies on AP automation software or Enterprise Resource Planning (ERP) systems with integrated AP modules. This connection creates a foundation that helps data sync between systems. The system can then pull open purchase orders, invoices, and receipts straight from the financial database.

The automation follows these steps:

When invoices come in through email, scanning, or direct ERP sync, the system’s optical character recognition (OCR) technology pulls out key data from these documents (vendor name, invoice number, date, line items, quantities, prices, etc.). The extraction works on both header information and line-item details. AI analysis combined with human verification achieves near-perfect accuracy rates.

Once ingested, the system organises the data, ensuring consistency across different document formats, and identifies key matching fields (PO number, line item numbers, quantities, and unit prices).

The system is configured with pre-defined rules for 2-way, 3-way, or 4-way matching. The matching algorithm then assesses the extracted invoice data against related purchase order information. This matching runs non-stop in the background and compares each invoice line to relevant PO lines based on preset rules.

Businesses can set tolerance levels (e.g., a 2% variance in price or quantity) to allow for minor discrepancies without flagging them as exceptions, preventing unnecessary manual interventions. Only exceptions outside these limits need manual review.

If a mismatch is detected (e.g., the quantity on the invoice does not match the PO or GRN beyond the allowed tolerance), the system automatically flags it as an exception. It can then route the exception to the relevant stakeholder (e.g., the purchasing manager, the vendor, or the receiving department) for review and resolution.

Many systems offer workflow automation, sending reminders and escalating issues if not resolved within a specified timeframe.

Once an invoice successfully passes the matching process (or an exception is resolved), it can be automatically approved for payment. The system then initiates the payment process, often integrating directly with banking systems or payment platforms.

The systematic approach transforms what used to be manual work into simplified processes that change how organisations handle their accounts payable tasks.

The future of purchase order matching

Purchase order matching is a critical financial control mechanism that significantly reduces fraud risks while enhancing operational efficiency. Throughout this article, we have explored how different matching approaches—from basic two-way verification to comprehensive four-way inspection—provide increasingly tighter protection against human errors and fraud.

Undoubtedly, automated matching systems enable businesses to reduce 90% of processing costs and time and capture valuable early payment discounts that directly impact the bottom line.

Nevertheless, the system’s success depends on technology as well as staff training. The core AP team must know standard procedures and exception-handling protocols to make the system work best.

Regular monitoring of key performance indicators gives valuable feedback to improve continuously, so the matching process keeps up with ever-changing business needs.

Purchase order matching has evolved from a simple verification task into a strategic financial control that boosts decision-making capabilities while protecting organisational assets.

Companies that invest in strong matching processes set themselves up for better financial performance, stronger vendor relationships, and much lower fraud risks in today’s complex business environment.

Can you say with confidence that your AP functions are efficient and there are no errors throughout the PO matching process? Are you protected?

Look no further, as TRG International has just the right solution for you–Yooz, a cloud-based, AI-powered purchase-to-pay solution, aims to bring all the benefits mentioned in this article to become a reality for your business.

Check out Yooz’s capabilities with this on-demand webinar!

References:

2. https://www.barclayscorporate.com/insights/fraud-protection/invoice-fraud/