Financial consolidation brings financial data from multiple entities into a single, accurate view of organisational performance. What was once a periodic reporting exercise has become a continuous operational process that supports compliance, decision-making, and speed of execution.

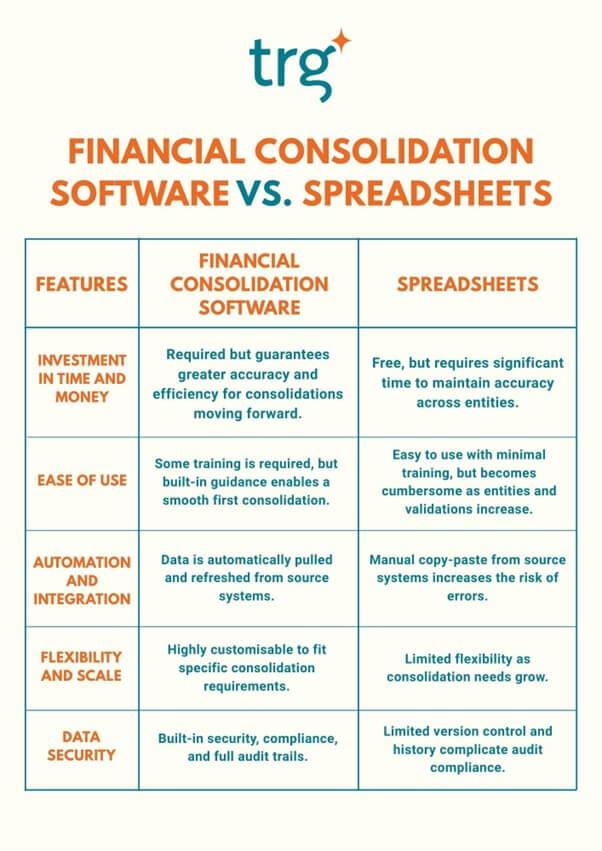

Finance teams nowadays are consolidating across more entities, more currencies, and stricter regulatory requirements, often under tighter close timelines. As this complexity grows, a key question emerges: Can spreadsheets still keep up, or is financial consolidation software a better fit?

Read more:Future of Financial Consolidation: Faster, Clearer, Connected

Key highlights

- Financial consolidation software supports the automation, control, and standardisation of the consolidation process, helping businesses close books faster.

- While familiar, accessible, and low-cost spreadsheets are often an effective initial tool for consolidation, they become a constraint as demands for accuracy, transparency, and scalability rise.

What Financial Consolidation Software Is Built For

Financial consolidation software is designed to automate, control, and standardise the consolidation process across entities and reporting periods [1]. Rather than relying on disconnected files and manual coordination, these platforms provide a structured environment for consolidation activities.

The intent is not simply automation for its own sake, but to reduce manual effort, improve accuracy and auditability, and support faster, more reliable reporting. By embedding controls and validation into the process, consolidation software helps finance teams manage complexity without increasing operational risk.

At a high level, these solutions typically support automated intercompany eliminations, currency conversion, and built-in validation and audit trails – features that address common consolidation challenges at scale without requiring heavy manual intervention.

Read more:Don’t Panic! Here’s How You Get Started with Automation

How Spreadsheets Are Commonly Used in Financial Consolidation

Despite the availability of dedicated software, spreadsheets remain widely used in financial consolidation. Their familiarity, accessibility, and low upfront cost make them a natural starting point for many finance teams.

Spreadsheets are often used to collect financial data from multiple entities, perform manual adjustments, and apply consolidation logic through templates and formulas. Their flexibility allows teams to handle ad-hoc changes and one-off scenarios with relative ease.

For small organisations, simple group structures, or short-term consolidation needs, this approach can be sufficient. However, what works well in simple environments often becomes a bottleneck as organisations scale.

Where Spreadsheets Start to Fall Short

As consolidation complexity increases, the limitations of spreadsheets become more pronounced. Manual data entry and formula-driven calculations increase the risk of errors that are difficult to detect and time-consuming to resolve.

Read more:7 Worst Financial Fiascos caused by Excel errors

Version control is another persistent challenge: multiple copies of the same file, shared across teams and entities, making it difficult to maintain a single source of truth. This lack of transparency is further compounded by the absence of a robust audit trail, which complicates internal reviews and external audits.

Over time, consolidation processes built on spreadsheets often become heavily dependent on a small number of key individuals who understand the logic behind complex files. This reliance creates operational risk and makes it difficult to scale consolidation across additional entities, regions, or reporting standards.

How Financial Consolidation Software Addresses These Challenges

Financial consolidation software addresses these challenges not simply by automating tasks, but by changing how consolidation is governed. Instead of relying on manual coordination across disconnected files, consolidation logic is embedded directly into the system, from data validation and adjustment rules to intercompany eliminations and currency handling.

Centralising data does more than reduce duplication. It enforces consistency by ensuring that changes are applied once and reflected across the entire consolidation process, eliminating the need for parallel updates and manual reconciliation between versions. This structural consistency becomes increasingly critical as consolidation complexity grows.

Read more:Why Infor EPM is the Definitive Solution for Modern Financial Consolidation

Built-in validation rules and audit trails shift control from post-close checks to ongoing process governance. Issues can be identified at the point of data entry or adjustment, rather than discovered late in the close cycle. This improves traceability, strengthens audit readiness, and reduces reliance on informal checks and individual judgement.

By standardising workflows within a single platform, consolidation software also reduces dependency on key individuals who “own” complex spreadsheets. Knowledge is embedded in the process rather than held by people, making consolidation more resilient, scalable, and sustainable as teams, reporting requirements, and organisational structures evolve.

Choosing the Right Tool for Your Consolidation Needs

Choosing between spreadsheets and financial consolidation software is rarely a matter of preference. In practice, the decision is driven by structural limits in how consolidation is governed, controlled, and scaled.

Source:Prophix 2023

As organisations grow, complexity does not increase linearly. Each additional entity, currency, or reporting standard introduces new interdependencies, such as intercompany relationships, adjustment logic, validation rules, that spreadsheets are not designed to manage systematically. What begins as a manageable workaround often turns into a fragile web of files, formulas, and manual checks.

The challenge becomes more pronounced when consolidation relies heavily on manual controls to ensure accuracy. Frequent adjustments, late data submissions, and post-close corrections increase the risk of inconsistencies that are difficult to trace back to their source. Without embedded controls and auditability, finance teams are forced to compensate with time, experience, and informal knowledge.

Read more:Conquering the Challenges in Financial Consolidation for Hotel Chains

Close timelines further expose these limitations. As reporting cycles shorten, there is less room for manual reconciliation and error correction. At this stage, the issue is no longer efficiency alone, but control, whether the consolidation process can remain reliable under pressure.

For many organisations, spreadsheets serve as an effective entry point into consolidation. However, as demands for accuracy, transparency, and scalability increase, they often become a constraint rather than a solution.

Taking everything into account, the debate between spreadsheets and financial consolidation software is rarely about tools alone. It is about how much complexity an organisation can manage without compromising control, accuracy, and confidence in its numbers.For finance leaders, the decision is not whether spreadsheets are “good enough”, but whether their consolidation process is designed to support where the organisation is heading.

TRG International works with finance teams to evaluate consolidation challenges and implement solutions that support accuracy, control, and long-term growth. Contact us now to get more information and suitable approaches!

FAQs

What is financial consolidation software?

Financial consolidation software is designed to automate, control, and standardise the consolidation process across entities and reporting periods.

Why are spreadsheets popular for financial consolidation?

Spreadsheets remain widely used in financial consolidation due to their familiarity, accessibility, and low upfront costs.

Financial consolidation software vs spreadsheets, which solution is better for consolidation?

For many organisations, spreadsheets serve as an effective entry point into consolidation. However, as demands for accuracy, transparency, and scalability increase, they often become a constraint rather than a solution.

References: