In the high-stakes world of corporate finance, modern CFOs are under constant challenges that require radical transformation. No longer confined to the role of a historical record-keeper, today’s CFOs are expected to be strategic visionaries, providing real-time insights that steer the company through increasingly volatile global markets. However, a significant roadblock remains: the dreadful, tedious, manual process of financial consolidation.

Does the thought of collecting disparate spreadsheets and turning fragmented data into sensible trends make you shiver? The complexity of closing books, for many, remains a logistical nightmare. Couple that with legacy systems that were never designed for the speed of modern business, and you have got yourself the formula for a disaster.

This is where Infor Enterprise Performance Management (EPM) emerges as the solution to save our sanity.

While we would love to dive straight into exploring all the good things of Infor EPM, let’s take a moment to understand why a solution like enterprise performance management is needed in the first place.

The issues with manual consolidation using legacy systems

The complexity of financial consolidation often stems from the endless number of spreadsheets, exhaustive data collection that crosses multiple departments and geographies, a manual process, and last but not least, the limitations of traditional, on-premise consolidation systems.

These legacy platforms were fundamentally designed for a different era, which already had its heyday, but its prime time has already passed. During that time, finance teams enjoyed longer reporting cycles, had simpler corporate structures, and managed a significantly smaller volume of regulatory and compliance mandates. What a wonderful time that was!

But in today’s hyper-accelerated business environment, modern CFOs and their teams are facing a totally different pressure:

- Shorter reporting deadlines, driven by the constant demand for transparency from investors, analysts, and public markets.

- Businesses are increasingly multinational. This translates to increasing multi-currency dramas and regulatory divergence.

- Mergers, acquisitions, divestitures, and internal restructuring are now a normal part of business strategy, which demands a consolidation system capable of dynamic, on-the-fly adjustment.

- Boards and leadership teams no longer accept delayed, historical data that takes weeks to generate. They require faster and more accurate insights into performance, key financial metrics, and forward-looking forecasts to inform critical strategic decisions.

Legacy systems struggle immensely to meet these modern demands.

Read more:Why Finance Professionals Only Have 5 Years to Reinvent Themselves & How to Do It

Delivering accurate, timely, consolidated results often requires heavy IT support for system maintenance and updates (and not to mention the whole ordeal of dealing with end-of-life software), constant manual workarounds (like off-system spreadsheets), or significant, time-consuming custom development to adapt to structural changes.

What is Infor EPM?

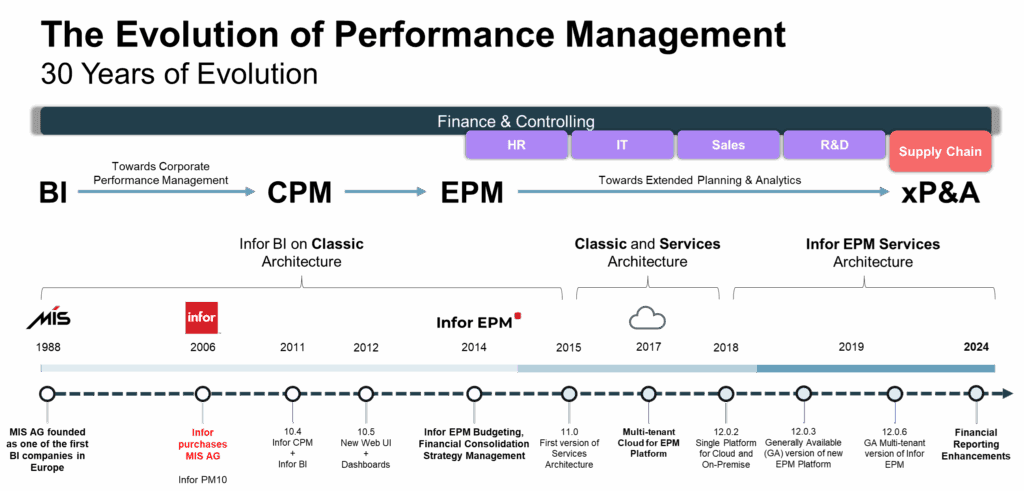

Infor EPM is a solution with a rich history of nonstop evolution. It is a comprehensive, integrated solution suite for planning, budgeting, forecasting, and financial consolidation, designed to simplify the financial and operational performance of an organisation. No, it is not merely a reporting tool. Infor EPM eliminates the data silos that traditionally plague the finance department and bridges the gap between strategy and execution.

Built on a modern, service-based architecture, Infor EPM leverages the power of the Infor OS (Operating Service). This provides a “data fabric” that connects various Infor systems, such as Infor SunSystems Cloud and Infor CloudSuite, as well as other third-party software, into a single source of truth.

The system utilises an in-memory analytical engine, ensuring that when data is updated, the impact is reflected across all models and reports instantaneously. For the finance team, this means moving away from data gathering and moving toward high-value data analysis.

Why CFOs should prioritise Infor EPM for financial consolidation

Infor EPM addresses legacy consolidation challenges by automating the end-to-end workflow. It provides a single integrated platform that simplifies even the most complex global structures.

Seamless data integration and validation

Infor EPM integrates directly with the Infor Data Lake and various third-party ERPs (including Infor SunSystems). It automatically reconciles and validates data through trial balance checks. This flexible data integration ensures that the data entering the consolidation engine is accurate from the start, though users retain the flexibility to make manual adjustments or corrections when unique accounting entries are required.

Comprehensive entity and group parameterisation

Managing diverse entities is simplified through flexible parameterisation. Each entity can be configured with its own specific chart of accounts, local currency, and reporting standards.

- At the Entity Level: The system automates exchange rate conversions and supports journal management for local adjustments.

- At the Group Level: CFOs can define complex legal structures, including varying ownership percentages. The system handles intercompany matching and elimination automatically, ensuring that internal transactions are wiped out to prevent the duplication of revenue or expenses.

Read more:Experts Explained: Breaking Down Data Walls with Infor EPM

Real-time visibility with the status monitor

One of the most powerful features of Infor EPM is the Status Monitor. It provides a “cockpit view” of the entire consolidation process across the whole group. Finance leaders can track the progress of every task, quickly identifying bottlenecks or entities that have not submitted their data. This real-time visibility ensures a faster, more predictable period close.

Read more:OLAP Technology: Handling Big Data in the Hotel Industry

Intelligent reporting

Beyond simple reports, users can access browser-based dashboards and mobile-friendly insights. A key advantage for many finance professionals is the native Excel integration. You can use the familiar Excel interface to interact with the robust Infor EPM model, combining the flexibility of a spreadsheet with the security and power of an enterprise database.

Infor EPM’s Financial Consolidation streamlines compliance with International Financial Reporting Standards (IFRS) or generally accepted accounting principles (GAAP). It achieves this by providing a controlled and auditable mechanism for tracing data from source systems all the way through to the final financial reports.

Read more:Nucleus Reports Infor EPM Improves Financial Productivity by 20 Per Cent

This proves the solution can manage complex ownership structures, multiple currencies, intercompany transactions and beyond.

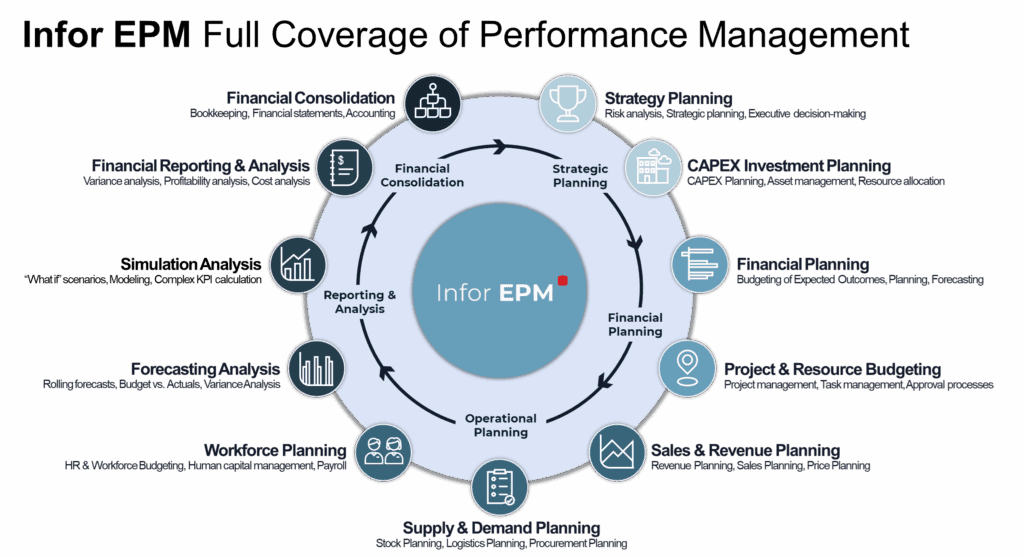

Check out our infographic below and a brief overview of Infor EPM’s complete set of capabilities.

Driving financial agility

Yesterday’s strategies and practices won’t always provide a clear path to solving today’s disruptive and complex challenges.

Infor EPM transforms financial consolidation from a burdensome administrative task into a strategic asset. By eliminating the heavy lifting of data integration, currency translation, and intercompany eliminations, it allows the finance team to focus on what truly matters: providing the insights needed to navigate today’s disruptive market.

The results speak for themselves. According to Nucleus Research, businesses using Infor EPM have seen a 20% improvement in financial process productivity and up to 30 times faster processing times for roll-up models. In an era where time is the most valuable currency, these gains are indispensable.

While we discuss the financial consolidation function of Infor EPM in this article, the solution is, in fact, more robust and capable of meeting more intricate business needs, from operational planning and forecasting, workforce budgeting, and sales planning to capital expenses planning, dashboarding, risk and strategy management, and more.

If your finance team still struggles with cutting down reporting cycles and providing meaningful insights that satisfy the Board of Directors, it is time to power up your financial toolkit! Seeing is believing, and we invite you to explore Infor EPM, especially how this solution can help streamline your organisation’s closing process. When you are ready, schedule a quick call with TRG International today!