For decades, your bank has been the rigid, rule-bound owner, letting no one but you and them inside. But now, that owner is changing their tune.

Open banking is here, a “digital transformer” that pushes financial institutions to share your financial data with third-party innovators, with your consent (of course) and for good reasons.

Get ready to see how your money—and how you manage it—is about to change forever.

Read more:Can Your Bank Reconciliation Process Be More Efficient?

Key highlights:

What is open banking?

Open banking is a revolutionary movement in the financial services sector. Banks, which are widely known for strict regulations and requirements, are now allowing third-party providers access to consumer financial data throughAPIswith customer consent.

Who are these third-party providers? They often are tech startups, financial institutions, fintech companies, e-commerce businesses, software developers, etc.

Why do they need to access consumer data? Open banking gives way to never-before-seen innovation for the financial sector, driving healthier growth and strengthening the relationships of this interconnected ecosystem, thus benefiting both businesses and customers.

Basically, it means banks are saying, “Hey, share your data with those nifty Fintechs; they might just make your life easier!”

We will dive into more details of open banking’s benefits in a later part.

Read more:Tech Tidbits: What Is An API?

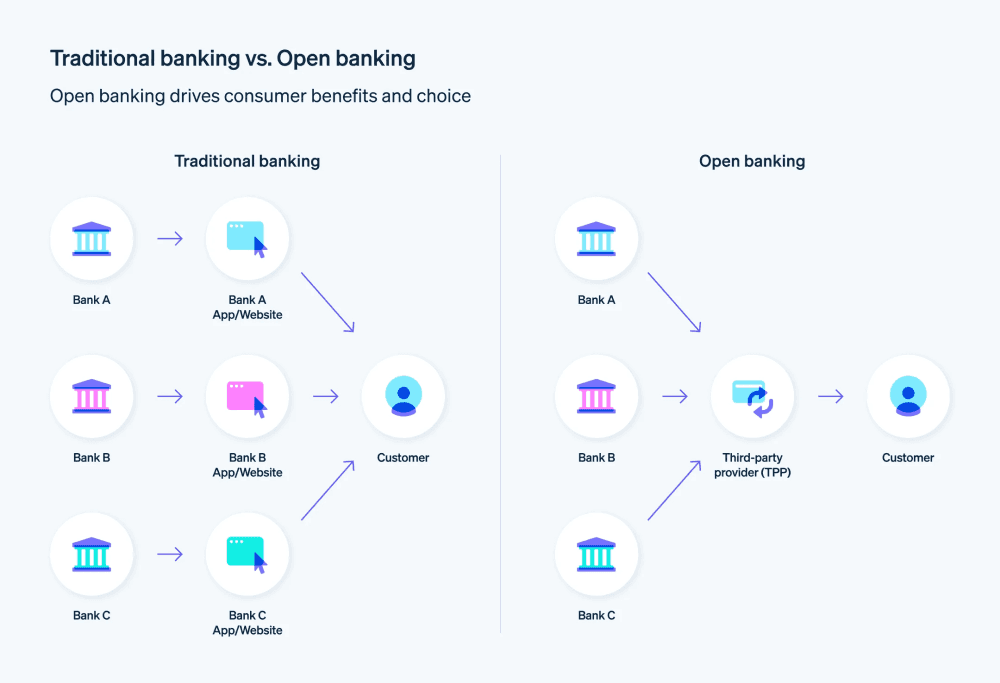

Image credit: Stripe

How open banking works

Open banking operates through secure application programming interfaces (APIs), which are essentially digital bridges that allow different financial institutions to communicate with each other with your permission.

Here is a brief look at how open banking works:

1. You, the client, play a role: The fundamental principle of open banking is consumer consent. Before sharing any data, you must explicitly grant permission to the third-party provider (TPP). This consent is typically given through your bank’s secure online portal or directly through the TPP’s application. So, be sure you read all the fine prints to not miss out on any critical information like this.

2. Secure data sharing through APIs: After securing your consent, the TPP uses an API provided by your bank to access specific categories of your financial data. Of course, these APIs are also designed with robust security protocols, such as encryption and strict authentication measures, to ensure that your information is protected during transit.

3. Third-party provider (TPP)’s actions: The TPP then uses the accessed data to provide you with a range of tailored services.

To put it simply, imagine your financial life as a giant pie. Open Banking is like a slice-sharing mechanism. You choose to share specific slices of your financial pie (your transaction history, account balances, etc.) with trusted third-party apps. These apps can then help you do things like manage your spending, compare mortgage rates, or find the best savings accounts—all without needing to dive into the chaotic world of banking paperwork. The best part? You get to decide what goes on your plate (what info you share) without needing to give anyone the whole pie!

Read more:10 Expert Tips for Managing Small Business Finances & Ensuring Success

Is open banking safe?

Open banking is safe! Organisations like Open Banking Limited in the UK design services with security in mind. Moreover, the security must be enforced at least three different points, happening simultaneously:

– Bank-level

– Local and international regulations

– And YOU! Yes, you are also part of the process. You are in charge of who is allowed to touch your own data.

Read more:A Simple Guide to Cloud Security: Best Practices, Challenges & More

On a more serious note, open banking is heavily regulated to protect you and all consumers. Regulatory bodies (like the Financial Conduct Authority in the UK or the European Banking Authority) oversee open banking frameworks, ensuring that TPPs are licensed, secure, and adhere to strict data protection rules (such as GDPR). This regulatory oversight, combined with advanced security technologies, aims to provide a safe and trustworthy environment for sharing financial data.

Benefits and practical use cases of open banking

Why should you care about open banking? Isn’t it much safer if your data is always kept confidential? Don’t turn your back on this technological advancement just yet. The solution not only benefits corporations but also consumers.

1. For customers

Without open banking, your account transactions, including how much you spent on groceries, shopping, Uber Eats/ Grab Food, subscriptions, etc., and even how much you earn, would just sit idly in your bank statements. And let’s be honest, how often would you open and read those statements?

Open banking brings more options, more competitive pricing, and a higher level of convenience. By securely sharing your finances with regulated companies, you can find apps, products, and services that let you stay on track and make more informed decisions about where your money should go.

Having a consolidated view of all accounts across different institutions is one of the benefits customers can gain. Instead of juggling between different platforms and logins, open banking allows customers to aggregate all transactions into a single dashboard to:

– Track spending and gain a deeper understanding of their spending habits

– Enable a more realistic budgeting now that consumers are aware of where their money is coming from and going to

– Provide financial advisors with a centralised and comprehensive view of the customers’ income, assets, and liabilities so they can offer more effective advice

Moreover, open banking also helps facilitate efficient payments, automatically and directly from your bank accounts to:

– Simplify the payment process and reduce manual transaction burdens

– Save time and effort, as you no longer need to sit through the entire process of validating your online payment

– Reduce the risk of human error in entering payment information, ensuring that payments are sent to the correct recipient for the correct amount

– Leverage the robust protection (various authentication methods) implemented by the third-party providers

– Schedule automated payments in advance to avoid penalty fees (e.g., for bills, subscription services, loans, etc.)

Read more:E-Invoicing Trends in Asia: What’s Next and How to Stay Ahead

2. For financial businesses

For financial institutions, such as banks, credit unions, etc., open banking can act like a catalyst for innovation. The technology and the collaboration with TPPs enable them to move beyond the traditional banking model and adopt a more agile and customer-centric approach to:

– Analyse aggregated customer data to gain insights into market trends and customer behaviours

– Develop new products and services by leveraging newly obtained knowledge to better meet their individual needs

– Provide a more holistic and intuitive digital experience for customers, e.g., simplified payment processes, smarter budgeting tools, or personalised saving/ loan schemes

– Explore new markets and offer value-added services through connections of the TPPs

– Optimise internal processes and automate manual tasks, such as accelerating loan applications, account openings, and other administrative procedures, which can lead to higher operational efficiencies, customer satisfaction, and, not to mention, cost reduction

– Access to a broader range of financial data can enhance credit scoring models and fraud detection, leading to more accurate risk assessments

Prime examples of the efficient partnership between financial businesses and TPPs are the automation of the Know Your Customers (KYC) and account verification processes for new accounts/ customers. The onboarding process can be sped up, and manual labour costs associated with compliance checks reduced.

Read more:7 Worst Financial Fiascos Caused by Excel Errors

Integrating third-party providers’ AI into banks’ mobile apps (for example, allowing the AI agent to suggest optimal saving amounts and duration) is another practical implication of open banking. This allows banks to attract customers by leveraging external AI tools and not having to invest heavily to build one in-house.

3. For non-financial businesses

Open banking enables non-financial companies to integrate finance seamlessly into their core services, significantly improving operations and customer loyalty. One of the most compelling advantages of open banking is its potential to reduce costs. Direct bank transfers often bypass the interchange fees typically charged by credit/ debit card networks. This translates into substantial savings for both businesses and customers.

Another example of how open banking can help non-financial businesses is streamlined financial management. A cloud accounting software provider can leverage open banking to pull transaction details directly from the business’ bank account, instantly match incoming deposits to outstanding invoices. This automated matching helps the business save hours of manual bookkeeping and leads to more accurate and better cash flow management.

Beyond cost saving, open banking allows businesses to verify funds or customer identity, thereby accelerating service delivery. Consider a utility company and how it can instantly verify a new customer’s bank account details. Once done, the customer can be set up with direct payment for their monthly bills, reducing all the admin hassles while saving the customer valuable time.

Finally, open banking opens entirely new revenue streams. A car dealership, for example, could integrate open banking into its website to securely view a customer’s financial health. With the information, the dealer can then offer personalised, pre-approved financing options directly to the customer.

According to a study done by Juniper Research, a UK-based research firm specialising in in-depth market research and strategic insights for the digital technology sector, open banking payment values will surpass $330 billion by 2027, up from $57 billion in 2023. This signals a widespread adoption of the technology, which in turn will foster more innovations to better serve the growing needs of both consumers and service providers.

The future of open banking will be more interconnected, efficient, and user-centric. However, central to this core is the tight integration between the third-party providers and financial services businesses. Instead of fragmented information and clunky, disparate platforms, technological solutions like open banking will bring holistic financial views to any stakeholders. The result? Smarter decisions, transparent and secure financial systems, higher financial literacy, and enhanced wellbeing.

Stay informed about open banking and other groundbreaking solutions by subscribing to the TRG Newsletter today!