TRG International is privileged to partner up with Sysynkt, a UK-based solution provider, to provide our clients with more versatile and cutting-edge solutions to streamline, automate, and optimise organisations’ financial management processes.

In this article, we will explore deep into the world of Sysynkt and what makes it a valuable addition to your financial tech stack.

Read more:Tech Tidbits: What Is Open Banking? A Simple Guide to Your Financial Future

What is Sysynkt?

Sysynkt the company was established in 2020, making it a fairly young start-up. However, it does not mean their solution is still in its infant stage. In an earlier talk with the teams at TRG International, Penelope (Penny) Phillips, Chief Commercial Officer of Sysynkt, shared that the company’s revenue has grown over 300% in the last three years.

As Penny frames it, Sysynkt is “an extended financial management system.” It is the first open banking solution for Infor SunSystems, which is also TRG’s key product offering.

Imagine SunSystems sits at the heart of your finance process, surrounded by all of the Sysynkt modules, providing a set of applications to enhance and supercharge SunSystems while also automating business processes.

Sysynkt is cloud-based and platform and application agnostic (meaning interoperable among various systems). The solution can securely connect with not just Infor SunSystems but also other finance software, CRM, and ERP via APIs.

Benefits of Sysynkt

Value for money

Organisations can get a faster return on investment with out-of-the-box integration and implementation. This translates to Sysynkt having already been well established and tested as well as readily available connectors for critical business applications, thus eliminating the need for expensive and time-consuming customisations. As a result, deployment time can be significantly reduced.

The implementation process is streamlined and strictly follows a standardised structure to reduce straining resources, allowing the organisation to transition more efficiently.

Sysynkt’s pricing is based on a flexible subscription model, allowing customers to control their monthly fees according to the estimated volume of transactions their organisation processes. To determine the most suitable package, companies should consider three key factors:

- The monthly volume of bank payments your company makes.

- The monthly volume of bank statement lines your company receives.

- The monthly volume of purchase invoices your company processes.

On top of that, Sysynkt offers an unlimited number of users, and organisations only pay for what they are actually using. This approach removes a major barrier to adoption and ensures that the platform’s benefits can reach across the organisation.

This ‘pay-for-what-you-use’ method ensures maximum value, eliminating wastage on unused licences or unneeded functionalities, and aligning the platform’s cost directly with the organisation’s operational needs and growth.

Ease of use

Sysynkt is designed with usability in mind. According to Penny, “If you can use a mobile phone, you can use Sysynkt.” The main objective is to build a solution that not only looks nice but is also simple and easy to use so there will be less resistance, in turn increasing the user adoption rate.

Additionally, the solution does come with Audrey, an AI-assisted document recognition engine to help extract and analyse data easily. The experts at Sysynkt spend countless hours developing tools that make the life of users easier. That is why Audrey not only can understand invoices but is also capable of helping users build sophisticated workflows and read multiple languages, handwriting, and photos.

Read more:What Do Two-, Three-, Four-Way Purchase Order Matching Mean?

Security

Sysynkt leverages open banking and a network of trustworthy partners and strong, certified software, infrastructure, and teams. The company is Cyber Essentials registered (a certification scheme backed by the UK’s National Cyber Security Centre to help ensure organisations’ and their customers’ data are safe from cyberattacks). Sysynkt is also certified for ISO/IEC 27001:2022 certification, marking its commitment to maintaining the highest standards of information security and data protection.

Key features of Sysynkt

1. Live banking

Open banking

One of Sysynkt’s biggest unique selling points is open banking, a safe and secure way to share data between the company’s financial management software and the bank. With open banking, both organisations and individual customers can initiate a payment or review bank statements electronically in a highly secure way.

For Sysynkt, open banking is the foundation for open finance, the ability to share the business’ banking data with lending organisations for a quicker and more efficient loan assessment, invoice distributions, and more. Open banking or open finance will pave the way for digital transformation in the finance world in the years to come. As of now, Sysynkt already connects with over 5,000 financial institutions globally. They are also the first and only open banking solution for Infor SunSystems.

Read more:Can Your Bank Reconciliation Process Be More Efficient?

Payments and remittances

Sysynkt helps streamline and automate the payment processes for businesses through its automatic remittances feature. It ensures remittances get sent out at the right time, to the right suppliers by email. Within the email, there can be an embedded ‘pay now’ button, providing a convenient and timely option, minimising the embarrassing late payment penalties.

Auto-reconciliation

The bank reconciliation at many businesses is still a labour-intensive process that costs countless man hours just to download bank statements, convert them to the correct file format required by the bank, upload them to the accounting software, and so on. Done manually, the process causes unnecessary delays and leaves ample room for human-prone mistakes.

Sysynkt’s open banking API automates the process for you. Instead of manually pulling files from bank portals, users can directly connect Sysynkt with their banks so that transactions are updated and matched in real-time.

2. Purchase invoicing

Mailbox integrations

The purchase invoicing feature in Sysynkt allows users to:

- Drag and drop an invoice into the system

- Create a manual invoice if necessary

- And attach a document

However, a smarter approach is to connect Sysynkt with the users’ inbox to automatically detect invoices as they come in. Users get notified when an incoming email has an attached document. Then Sysynkt’s Audrey AI-assisted tool scans and captures the invoice information and pushes them towards wherever necessary for further processing.

Read more:E-Invoicing Trends in Asia: What’s Next and How to Stay Ahead

Document capture & Smart integrations

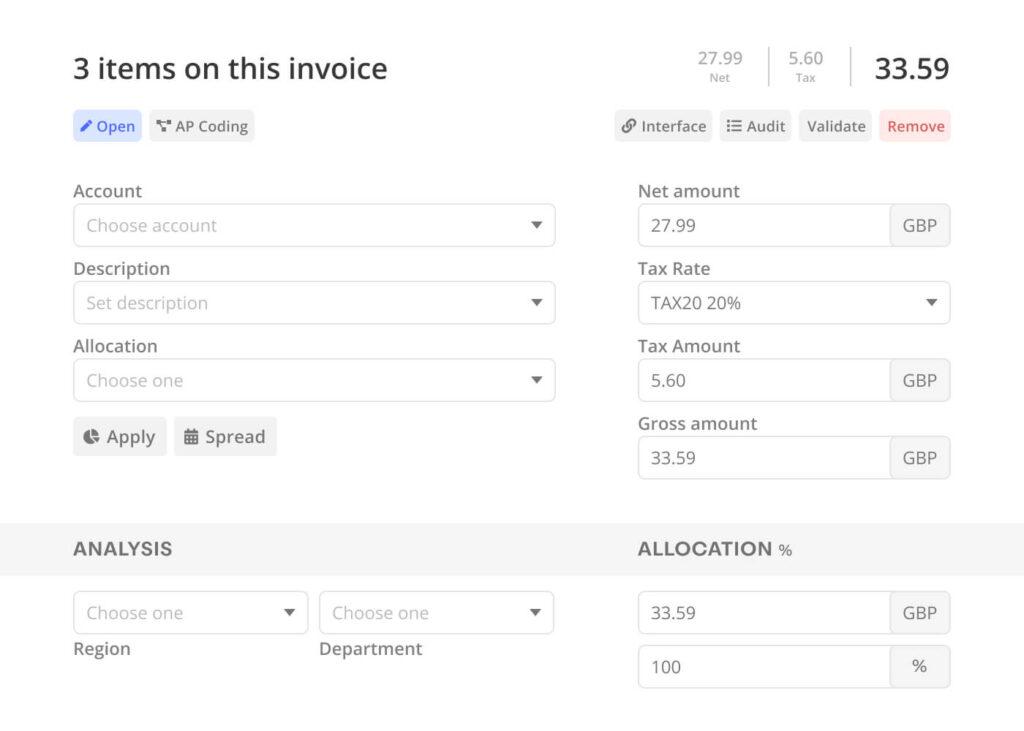

Additionally, Sysynkt can also be set up to integrate with a larger set of finance tools to help make the accountant’s job easier, such as automatic VAT or tax code checking, which can happen simultaneously as invoices are coming in and being processed.

Upon receiving an invoice, Sysynkt reads and analyses specific data points, such as tax codes and bank details. It then performs a cross-referencing analysis to ensure the information on the invoice corresponds with registered tax details, verifying that the supplier is currently registered for tax purposes. This process fundamentally acts as a measure of fraud prevention, ensuring due diligence is performed on all incoming invoices.

Sysynkt is also capable of detecting minor but significant changes that may not constitute fraud, such as a supplier updating their bank details. This capability highlights the primary benefit of integrating these systems, which is to facilitate significantly more efficient and secure business processes.

Invoice – Credit: Sysynkt

3. Procurement

Full procurement cycle

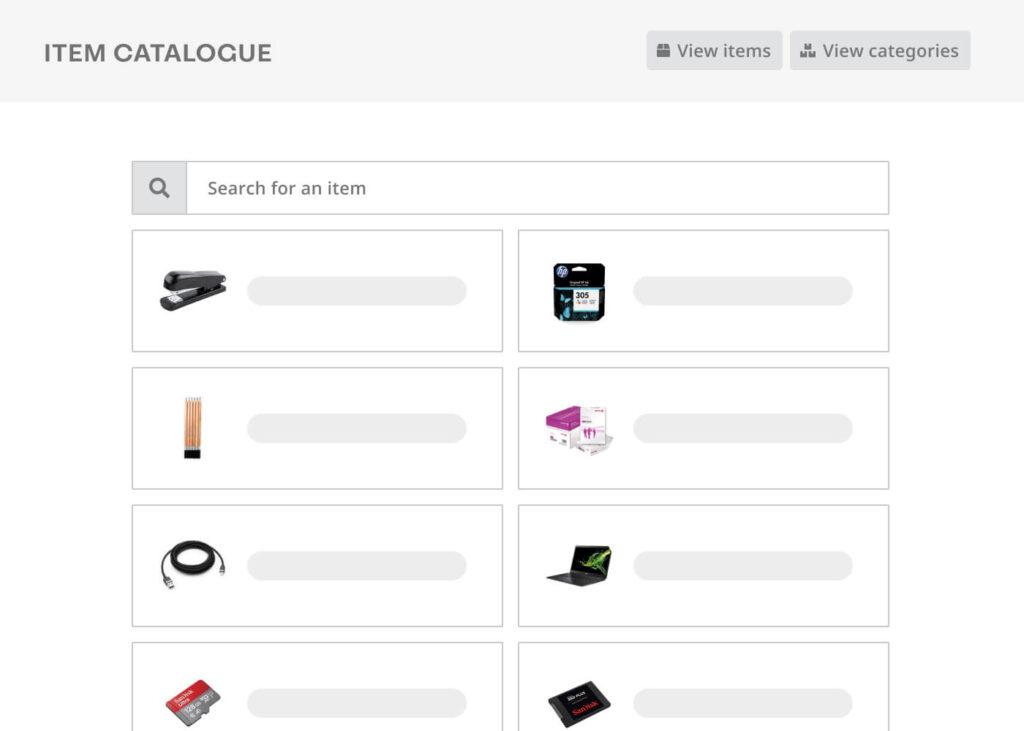

Sysynkt offers features to support the company’s complete procurement cycle, from initiating purchasing requests to issuing receipts, invoice matching, and so on.

Sysynkt automates the ordering process by sending orders directly to suppliers. Following this, the items can be optionally receipted before being matched to Purchase Invoices handled by Sysynkt’s Audrey.

For enhanced supplier management, customers have the option to set up a customisable supplier portal. This self-service portal allows suppliers to view their outstanding invoices and orders, as well as update or verify their company details.

Audit trail

An audit trail is maintained for every transaction. The history shows, for instance, who approved the transaction and on what date, or if it was rejected and returned to the originator. A visible history is always available once the transaction is sent to SunSystems.

Budget checking

Sysynkt’s budget checking function empowers both finance and procurement teams to make informed decisions faster. Understanding the bottlenecks potentially caused by delayed reports and batch updates, the team at Sysynkt developed budget checking, a vital function for an efficient procure-to-pay lifecycle that lets users check budget availability in real-time, directly against the actuals held in SunSystems.

Read more:How to Build a Budget Management Culture: A Step-by-Step Guide for Managers

Item catalogue – Credit: Sysynkt

4. Supplier management

Sysynkt digitalises the supplier onboarding and oversight processes. This starts with users creating a customised supplier portal for:

- Issued purchase orders

- Invoice statuses

- Etc.

Compliance checks can also be built in to further streamline processes. For instance, users can have a built-in request, asking the suppliers to upload their insurance certificate or provide specific information. For smaller suppliers, validation of their bank details can be achieved through open banking methods or via a letter on letterhead.

Suppliers can also be granted granular permissions; however, the company holds the ultimate level of control for who sees what.

5. Expenses

Mobile expense capture

Sysynkt provides intuitive expense capture, approval workflows, and policy compliance. There is an expense app available to help ease and fast-track receipt capture. The AI-assisted document recognition engine, Audrey, then takes over and processes the claims.

This immediate, on-the-go capture capability accelerates the entire expense reporting process, ensuring that all spend is accounted for accurately at the point of transaction.

Read more:3 Tips to Effectively Manage Your T&E Expenses

Mileage claims

Another handy and time-saving feature of Sysynkt is the capability to process mileage claims using Google Maps to detect the employee’s route. The automated route detection provides an objective basis for calculating travelling distance, thereby ensuring that mileage claims are fair, accurate, and fully compliant with company policies.

Company’s policy and rules

Businesses can set the system up with their own policy and rules. Sysynkt can then match expenses with corresponding entries on corporate credit card statements, thus significantly streamlining the reconciliation process and providing a clear, auditable trail.

Recharge expenses

Users can “tag” relevant expenses as “recharge” if they meet the company’s required criteria. Once an expense has been appropriately tagged for recharge, it is then automatically queued for inclusion in that customer’s upcoming sales invoice.

6. Plug-ins & Integration

Businesses can leverage Sysynkt’s ready-to-go library of plug-ins and public APIs to extend and enhance their existing financial infrastructure, whether it is on-premise or in the cloud. With Sysynkt, users can monitor all integrated data via a synchronisation dashboard to gain a clearer visibility into every single payload, thus simplifying both auditing and overall financial management.

Besides financial management, Sysynkt can also connect with and pull data from other critical business applications like Slack, Teams, or HubSpot to create a more well-rounded look into the impact of finances on different areas of the business.

Ready to see Sysynkt in action? Don’t just read about it, try it! Request your personalised demo today and discover how your finance function can also be transformed, too!