The role of modern CFOs today feels broader and heavier than it used to be, as beyond managing the numbers, they are also expected to:

- Shape strategy

- Anticipate risks

- Support growth initiatives

- Clearly explain financial performance to boards and investors

And they juggle all of these while under intense time pressure. As a result, modern CFOs are expected to deliver quality, accurate reports FAST.

But (there’s always a but), the tools they use daily are just subpar. Financial information still arrives after due dates, often fragmented and buried deep within different systems or spreadsheets that require lots of digging to reconcile.

Hmmm, why does this sound so familiar?

Read more:What Leading CFOs Are Doing Differently to Tame Intercompany Transactions?

Real-Time Financial Dashboards: Yay or Nay?

Real-time financial dashboards aim to close the information gap. They provide a live view of financial performance by pulling data directly from core systems such as ERP platforms, accounting software, CRM applications, and budgeting tools, and presenting it in a single visual interface.

Unlike traditional reports that often are produced weekly or monthly, these dashboards update continuously as transactions occur. What appears on screen reflects current conditions, not a snapshot from days or weeks earlier. Critical metrics such as cash position, revenue trends, expenses, budget variances, and rolling forecasts are displayed visually, making it easier to spot patterns or issues without extensive manual analysis.

Automation plays a central role here. Data is automatically collected, consolidated, and visualised, which reduces reliance on spreadsheets and lowers the risk of manual errors.

Read more:Let’s Breakdown Automation, Hyperautomation, Intelligent Automation

What does this mean? Picture:

- Hours spent on pulling data together and checking it line by line? Not happening!

- Finance teams focus their energy on interpreting results and deciding the next course of action? Yes, it’s happening!

Through these intuitive and role-based dashboards, executives and operational leaders can see the same numbers at the same time, which creates a shared understanding of financial performance across the organisation. In practice, this often reduces misalignment and leads to more focused conversations about priorities and trade-offs.

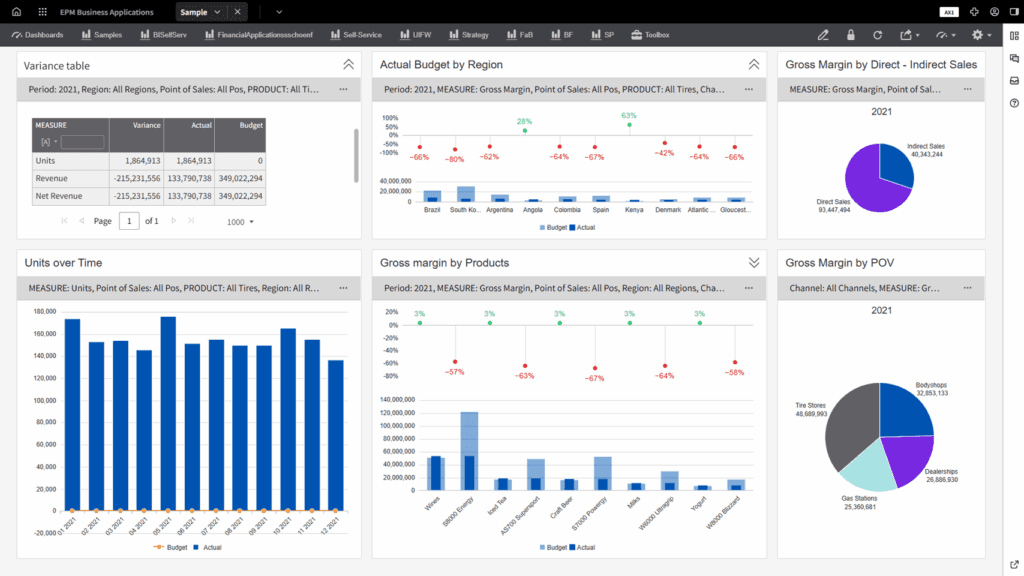

Example of a visualised dashboard powered by Infor EPM. Image credit: BARC

The Benefits of Real-Time Financial Dashboards

Enhanced Visibility and Financial Control

With up-to-date insight into the company’s financial movements and health, revenue inflows, leaders are better equipped to manage liquidity and short-term obligations. This visibility also supports stronger financial control by increasing confidence in reported figures and reducing uncertainty across leadership teams.

Read more:“Greenifying” Energy Sector Starts with Strong Finances

Faster and More Informed Decision-Making

Sound decisions depend on timely information. Real-time dashboards shorten the gap between what happens in the business and when finance becomes aware of it. Instead of waiting for the next reporting cycle, CFOs can respond to emerging trends or concerns as they appear.

This becomes particularly valuable in fast-moving environments. Whether adjusting spending, reallocating resources, or responding to market changes, finance leaders can rely on current data rather than assumptions or outdated figures.

Faster decision-making with intuitive, role-based dashboards powered by Infor EPM

Improved Forecasting and Planning Accuracy

Forecasts are only as reliable as the data that supports them. When planning relies heavily on historical or incomplete information, confidence in the numbers inevitably erodes. Real-time financial dashboards help improve forecasting by feeding current data into planning and scenario models on an ongoing basis.

Forecasts are no longer locked in until the next planning cycle. As conditions shift, CFOs can revisit assumptions, explore different scenarios, and adjust plans with more confidence. Over time, this improves both short-term responsiveness and longer-term strategic planning.

Read more:Answers to Common Executive Questions About Financial Forecasting Tools

Reduced Manual Effort and Greater Efficiency

Finance teams still spend far more time producing reports than actually analysing them. Pulling data, reconciling figures, and formatting spreadsheets can quietly consume resources that would be better used on more strategic work.

As a result, finance professionals can focus more on insight and advisory work. This improves productivity, reduces errors, and strengthens the overall quality of financial information. Over time, these gains also support a more efficient and effective finance function.

Proactive Risk Identification and Management

Real-time dashboards support a more proactive approach to risk management. Continuous monitoring makes it easier to spot unusual patterns, such as unexpected cost increases, declining margins, or delayed receivables.

When these signals appear earlier, CFOs have more time to investigate and respond before issues escalate. This reduces the likelihood of financial surprises and supports a more resilient approach to managing uncertainty.

Read more:Third-Party Risk Accounts for 59% of Insurance Data Breaches. Why?

Stronger Collaboration and Stakeholder Communication

When leaders are looking at the same information, discussions tend to stay more focused and decisions are easier to align.

Real-time dashboards also change how finance communicates with external stakeholders. Boards, investors, and lenders now expect financial insight that is both timely and transparent, not weeks out of date. Real-time dashboards allow CFOs to present a current and credible picture of performance, reinforcing trust in financial reporting.

From Retrospective Reporting to Real-Time Insight

As the CFO role continues to evolve toward strategic leadership, access to timely and reliable financial insight has become increasingly important. Real-time financial dashboards help narrow the gap between what is happening in the business and what finance can see.

By automating reporting, improving accuracy, and enabling faster, better-informed decisions, these dashboards support a shift away from retrospective reporting toward more proactive financial management. In a business environment defined by constant change, they are becoming a defining capability of high-performing finance teams and modern CFO leadership.

How else is the role of modern CFOs impacted? Should they forgo all traditional standards and best practices learned through years of experience and start afresh with AI and other emerging tech? Check out our latest whitepaper for a deeper dive into the evolving roles of a modern CFO, what organisations and other business leaders expect of them, and how they can meet new realities with confidence.