Vietnam’s journey toward adopting International Financial Reporting Standards (IFRS) is a significant step towards global economic integration and transparency. However, this transition, guided by Vietnam’s Ministry of Finance’s Decision 345/QĐ-BTC, presents several challenges for businesses.

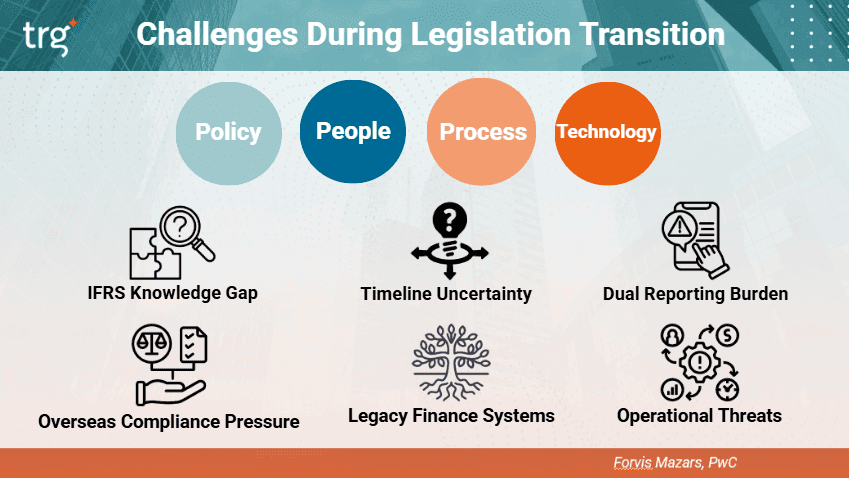

TRG’s recent survey from the “Digitalisation for Financial Legislative Readiness” workshop highlighted four key hurdles and revealed how technology can transform them from burdens into competitive advantages.

Roadblocks to IFRS adoption in Vietnam

TRG experts emphasised during the event that IFRS adoption is not just a regulatory checkbox. The shift in both reporting standards and operational processes presents four primary challenges that businesses reckon with:

1. Dual reporting and extra workload

In the initial phase, companies must report under both the existing Vietnamese Accounting Standards (VAS) and IFRS. This essentially leads to doubled workloads, increased costs, exhaustive resources, and significantly more risks and errors if done manually.

Read more: Why Finance Professionals Only Have 5 Years to Reinvent Themselves & How to Do It

2. Pressure from foreign stakeholders

According to the IFRS Foundation, 161 of the 169 jurisdictions worldwide have committed to IFRS Accounting Standards. In the Southeast Asia region, countries that have adopted this standard include Brunei Darussalam, Cambodia, Malaysia, Myanmar, Singapore, Thailand, and the Philippines.

As the parent companies use IFRS, this puts pressure on their Vietnamese subsidiaries to transition. As a result, the pressure creates an urgent need for preparation and a steeper learning curve than anticipated.

3. Outdated legacy systems

Vietnamese businesses still rely on outdated accounting software andspreadsheets that were not designed to comply with IFRS or dual reporting. These systems become major roadblocks, causing operational inefficiencies and making the transition difficult and error-prone.

Read more:7 Worst Financial Fiascos caused by Excel errors

4. Operational risks

Adopting a new accounting standard impacts not just financial reports but also the daily operations of the business. Without proper preparation, which includes fulfilling IFRS knowledge gaps among employees, businesses can face significant disruptions, data inaccuracies, and a loss of credibility with shareholders and partners.

Digitalisation = The solution to IFRS challenges?

Overcoming these four core challenges requires more than just manual processes or hiring more staff. Digital transformation is the key to a successful, cost-effective, and efficient transition.

Here is how technology turns these challenges into opportunities:

– Handling parallel reporting: Modern financial systems, such as Infor SunSystems Cloud, can run both VAS and IFRS side-by-side, eliminating the need for dual data entry and streamlining reporting.

– Workflow automation: Digital solutions automate repetitive tasks, reducing manual input and minimising the risk of human error. This frees up finance teams to focus on strategic analysis rather than data entry and reconciliation.

– Handling complex standards: Advanced platforms like Infor EPM provide pre-built and custom report templates that are both IFRS and local regulatory compliant. These solutions can handle complex tasks, such as financial consolidation and analysis, saving valuable time and resources.

– Enhancing accuracy and transparency: A unified digital system integrates financial and operational data, ensuring a single source of truth. This improves the accuracy of financial reports and enhances transparency, building trust with stakeholders and providing management with real-time insights for better decision-making.

Read more:Navigating Challenges: the Worrying State of Digital Transformation for SMEs

The IFRS transition brings significant challenges. Still, the standard also presents a major opportunity for businesses operating in Vietnam to improve transparency and enhance their global standing.

Nevertheless, the transition requires significant investments into adequate training and digitalisation to enforce and enhance compliance, thus ensuring IFRS adoption is not a burden but a competitive advantage.

For a deeper understanding of the current IFRS transition landscape in Vietnam, check out our key highlights and on-demand resources presented at the recent “Digitalisation for Financial Legislative Readiness” workshop.