In hospitality, seasons are not just the change in the weather; they impact the entire business’ bottom line. One month, you max out the hotel’s capacity but struggle to cover your half-empty rooms the next.

The “peaks and valleys” push hospitality leaders to seek a solution that provides both balance and assurance for when the revenue dips and expenses roll in—treasury management. It is the quiet engine that ensures hotel businesses maintain a healthy cash flow while minimising risks and planning ahead, regardless of the season.

In this blog, we will go into detail about the role of treasury management in the hospitality sector, particularly for hotel businesses, and why this function can enable them to stay flexible when demands fluctuate.

Read more:Financial vs. Treasury Management: Unpacking Key Differences

Understanding the seasonal shifts in hospitality

Seasonality is one of the defining characteristics of the hospitality industry. While other industries experience consistent demand for their products or services, hospitality has high and low periods based on a multitude of factors, be it the calendar or the climate.

The nature of seasonality: Peaks vs. Valleys

To better understand the concept, let’s consider the case of Aspen, Colorado (USA). Aspen is a town that experiences a significant amount of seasonal ski tourism in the winter months and a major dip the rest of the year.

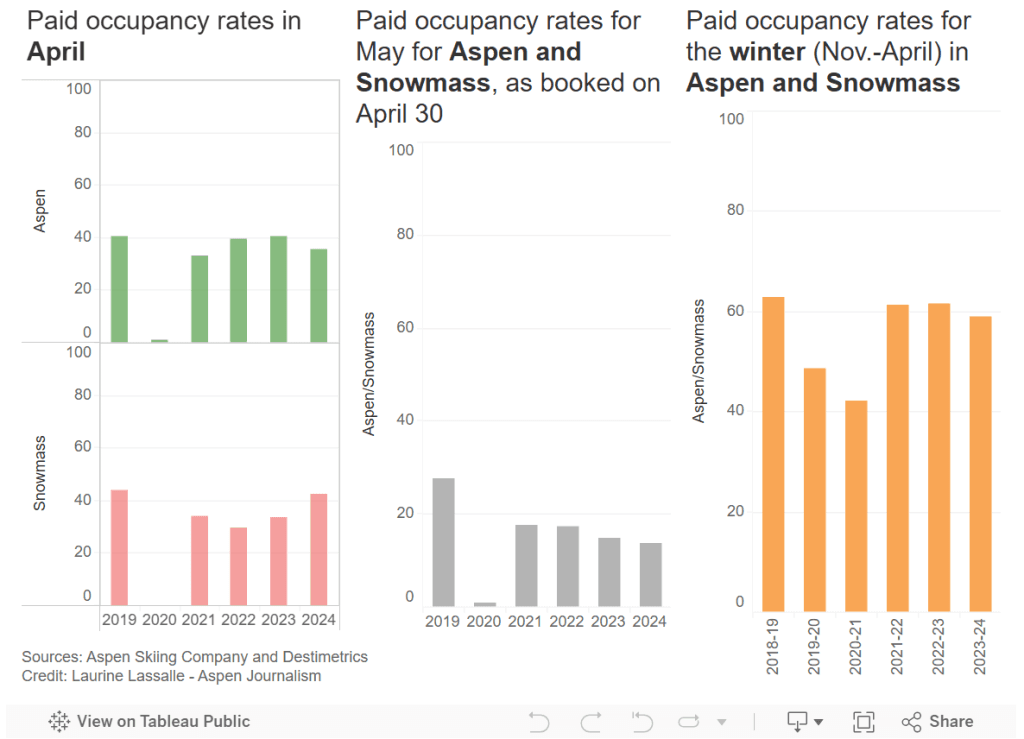

According to Aspen Journalism, during the winter peak, Aspen receives an enormous number of visitors from around the world. For example, in January 2024, Aspen’s hotel occupancy reached 72.2%, and nearby Snowmass was closed at 70.8%. The momentum continued in March, with the combined occupancy across Aspen and Snowmass able to hold just under 73%.

Read more:How Hotels Should Respond to the Ongoing Business Travel Boom

Once the snow melts, the demand sharply declines.

By April, the spring slowdown is complete. In April 2024, paid occupancy across Aspen and Snowmass dropped to 32.3%, which is just a little over half of what it was a month earlier. And these low occupancy levels are typical for their off-season time, year after year.

Sources: Aspen Skiing Company and Destimetrics – Aspen Journalism

Key drivers of seasonality include:

– Weather and climate: Ski resorts peak in winter, beach resorts in summer.

– Holidays and school breaks: Families travel more during spring and summer breaks.

– Major events: Conferences, concerts, or sporting events can temporarily spike demand.

– Economic patterns: Recession fears or inflation can lead to unexpected dips.

The difference in demand levels during peak and off-peak periods is significant, sometimes even belligerent. Below are more figures to illustrate the scale of ‘seasonality’ on performance levels:

– According to STR, in 2023, national hotel occupancy rates in the United States averaged 73% in July but then dropped to 53% in January, meaning there is a 20-point difference in revenue. [1] [2]

– According to Eurostat, the gap is larger in the European hotel sector, with Mediterranean resort reports showing occupancy rates of 85% in August and just 30-40% in the winter months. [3]

Aspen’s seasonal rhythm is a perfect example of the pronounced extreme swings faced by hospitality businesses. This stark contrast between busy and lull months highlights the importance of effective treasury management to prevent crises, thereby giving hotels the means to remain financially viable through the peaks and valleys of mountain tourism.

Key challenges hoteliers face during seasonal shifts

Seasonal variance affects all facets of hotel administration. Even the most experienced operators are challenged by seasonal shifts because of their erratic fluctuations in revenue and demand.

Revenue volatility

For hotel operators, the highs in peak season versus the slower times in the off-peak season mean unstable revenue that can disrupt cash flow management and profitability.

According to an article on Business Plans Templates [4], operational costs for hotels can range from 30% to 50% of total revenue, depending on factors like location, scale, and service level. During off-peak months, when revenue decreases, these fixed operational costs remain, which can eat away at profitability and cash reserves.

Longer-term investments, such as renovations or a new tech rollout, can get pushed further down the list of priorities, while paying back debt can be even more challenging, especially for hotels that were operating at slim margins.

Read more: How to Boost Hotel Revenue with Non-Room Services

Operational cost management

Hotels tend to hire a large number of temporary employees during peak periods to meet guest demands. But once the off-season arrives, maintaining that same level of staffing is unreasonable, or else hotels risk facing bloated payroll costs when revenue is already going thin.

On the other end of the spectrum, some hotels try to remain lean all year round and end up having to scramble when an influx of guests arrives unexpectedly. This results in understaffing and a drop in guest service standards.

These seasonal fluctuations are the treasury function’s concerns and have a real impact on financial planning and cost control.

Read more:7 Steps to Take Your Revenue Management to the Next Level

Other seasonal operational cost management challenges include:

– Wasted inventory of perishables or supplies that go unused.

– Energy costs that remain high, whether occupancy is high or low (e.g., heating or cooling large facilities).

Risk management

The hospitality industry faces a multitude of operational risks, including but not limited to:

– Weather-related disruptions (e.g. hurricanes, blizzards, droughts)

– Economic downturns (e.g. consumers cutting back on travel and/or eating out)

– Health-related crises (e.g. pandemics or localised outbreaks)

– Geopolitical instability that influences travel patterns and guest behaviour

The financial consequences of these risks are far from hypothetical. A 2023 Deloitte study revealed that 43% of hospitality businesses were financially unprepared for at least one major disruption in the past three years. [5]

This is where treasury management steps into the picture. Risk-aware treasury teams are those who help the business maintain its financial strength by:

– Keeping standby credit lines readily accessible with pre-negotiated terms for the swift infusion of liquid cash

– Building cash reserves that rotate in line with the movement of cash flow through the seasons

– Applying for insurance or financial hedging to ensure protection against commodity price oscillations and exchange rate instability

Forecasting and planning

Demand forecasting in hospitality is crucial, yet never perfect. Seasonal trends provide good hints, but unforeseen events can send projections astray instantly. Even small errors in forecasting can be very costly. According to STR, hotel demand forecast inaccuracies can range from 5% to 20%, depending on the market situation.

This forecasting volatility impacts far more than room bookings:

– Inaccurate forecasts may result in overstaffing or understaffing.

– Inventory availability may not match real guest demand.

– Pricing and promotion strategies may be off target, wasting precious budget.

Read more:10 Common Mistakes in Financial Forecasting & How to Avoid Them

That is why treasury teams must build resilience into financial planning. Robust treasury systems rely on multi-layered forecasting – a mix of historical, real-time booking trends, market indicators, and local intelligence. Rolling forecasts, updated monthly or quarterly, allow hospitality firms to stay nimble, protect cash flow, and pivot quickly when a surprise hits.

Are you feeling the ebb and flow of the seasons creating ripples of uncertainty in your hotel finances? Well, let’s proactively deal with these hurdles and turn potential threats into managed flows.

At TRG International, we keep a keen eye on the ever-shifting currents of the hospitality industry. Sign up for our newsletter below to receive practical and professional expertise to keep your treasury in calmer waters!

References:

[1] https://str.com/data-insights-blog/us-hotel-commentary-july-2023

[2] https://str.com/press-release/str-us-hotel-performance-january-2023

[4] https://businessplan-templates.com/blogs/running-costs/hotel-and-resort-development

[5] https://www2.deloitte.com/content/dam/Deloitte/us/Documents/us-2023-travel-outlook.pdf