Transitioning from legacy accounting software to a cloud-based system can be challenging, especially amidst today’s economic uncertainties and downward trend. Nevertheless, embracing innovative technologies can be one of the smart strategies for businesses to stay ahead.

Committed to making this switch requires careful planning and evaluation of all potential issues. And TRG is here to help you along the way. In this article, we will give a roadmap on how to transform in the most effective and cost-efficient way.

Read more:Key Trends in the Accounting Software Market

Evaluate your readiness for cloud migration

Before you begin this important change, businesses must conduct a careful revision and evaluation to determine if they are ready to handle the cloud migration. A detailed cloud readiness assessment will be your roadmap that gives businesses clarity and direction during the transition.

The assessment gets into your current financial systems and processes first. Thus, leaders and finance teams need to understand the ins and outs of their existing setup to identify limitations and see how cloud solutions could resolve these issues and enhance the team’s productivity. This initial review helps finance teams figure out what they need from the new cloud financial management software and spots potential roadblocks ahead.

Read more:4 Blueprints for Your Enterprise’s Cloud Strategy

A full readiness review comprises four vital pillars:

– Technical readiness: Review the compatibility of the business’ current IT infrastructure, applications, and data with cloud environments. Think about network bandwidth, server capacity, and software dependencies, which might affect the migration strategy.

– Operational readiness: Review your team’s ability and expertise to support the transition. This review has to cover available human resources, knowledge gaps, and additional training needs.

– Financial readiness: Explore different migration options and their associated costs as well as long-term operational expenses, define budget limits, and create a detailed financial plan that covers software licensing, data transfer, and possible downtime.

– Security and compliance: Make security and privacy requirements your priority, especially for sensitive financial data. Review existing security mechanisms and compliance standards to avoid post-migration vulnerabilities.

While doing this assessment, we recommend looking at the scope of the transition, including:

– Number of users

– Data migration

– Integration with other systems

These factors will help you grasp the preparation workload needed before researching possible solutions, such as Infor SunSystems Cloud.

Read more:10 Factors to Consider When Choosing Your Cloud Deployment Option

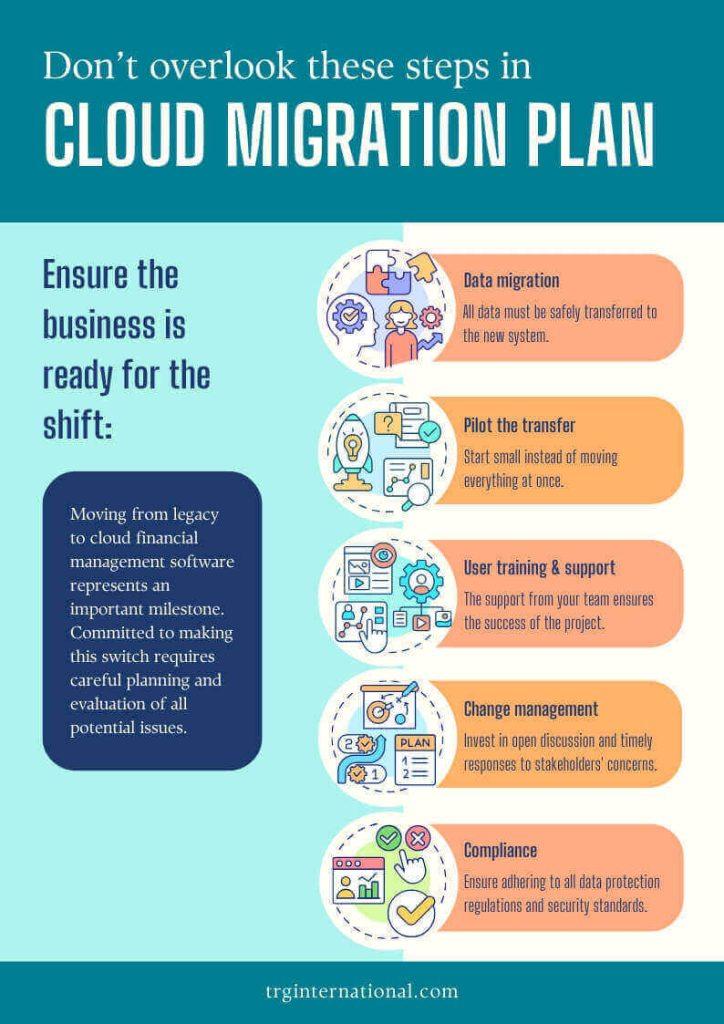

Necessary steps to be included in the business’ cloud migration plan

Once the business has ensured they are ready for transitioning from the legacy accounting software to a cloud-based one, the next crucial step is to create a well-laid-out migration plan.

Data migration

We cannot stress enough the importance of a well-defined data migration strategy. All current and historical financial data must be safely and accurately transferred to the new system.

Good data preparation is the foundation of successful cloud migration:

– Start with a detailed data audit to check accuracy and consistency.

– Export financial data from the current systems.

– Use your vendor’s migration tools to import it into the news cloud solution.

This is also the prime time for businesses to clean up their database to clean up all “the trash,” guaranteeing only the most up-to-date and useful information remains while ensuring the new system is clutter-free.

Read more: Proper Data Preparation: Key Ingredient Ensuring a Smooth Cloud Migration

Pilot the transfer

Running a migration test in a controlled environment before the actual transition from the legacy system to the cloud will help unveil possible hiccups. The best approach is to start small, using a pilot group, a small subset of data, clients, or specific modules instead of moving everything at once.

This strategy helps businesses:

– Spot issues early

– Test how the system works

– Make real-time adjustments

– Understand the system more deeply

– Check data integrity

– Create a backup plan if things go wrong

Note that quality matters more than quantity during pilot phases. These controlled migrations teach you valuable lessons for your complete transition.

User training and customer support

Get your finance team involved right from the start of implementation. The support from your team plays a critical role in ensuring the success of the transition project.

Give them detailed training that fits different learning styles through videos, documentation, and hands-on sessions. The proper end-user training for everyone, from your most seasoned professionals to newcomers, is vital for enabling them to get up to speed quickly.

Read more:The Need for Industry-specific On-demand Training for End Users

Moreover, don’t forget to collect feedback from team members! Encourage them to give their opinions, insights, challenges, and suggestions for improvement. This step is not only important for improvements but will also give employees the feeling that they are being heard and listened to in this new environment.

Additionally, timely support protocols and established communication channels will help smooth out any technical problems faced during the transition. Questions from stakeholders or employees might continue to arise, even after the transition phase. Therefore, effective support not only can remediate hindrances on time but also solidify the foundation for transitioning success.

Change management

Change management is the lifeblood of successful cloud implementation. Get executive buy-in early to keep the momentum going and keep resistance at bay. Executives can champion the change, providing the necessary resources and authority to drive the initiative forward.

Creating a comprehensive communication plan detailing the benefits of shifting away from an on-premise model to cloud financial management software is another critical component of effective change management. This plan should highlight key advantages after transitioning, such as reducing manual labour, automating workflows, and enabling real-time, impactful decisions to be made. These factors can help contribute to building a compelling case for change, as well as address potential concerns and foster a positive attitude towards the digital transformation project.

Read more:How financial data is protected on Sunsystems Cloud

Moreover, businesses should invest in open discussion and timely responses to stakeholders’ and team members’ concerns. Regular updates on the progress throughout the transition can further strengthen trust, ensuring all parties are aligned with the goals of the cloud implementation. Actively engaging with stakeholders and members from the finance team can help create a supportive environment that facilitates a successful transition to the cloud.

Compliance

The chosen cloud financial management solution and its provider not only adhere to all data protection regulations and security standards but also are capable of anticipating future changes. This involves a comprehensive understanding of the legal landscape and a proactive approach to compliance. Implement robust data protection measures, including advanced encryption techniques and secure transfer protocols, to ensure data integrity during transmission.

Additionally, establish a comprehensive set of risk controls to stay compliant, both during the initial transition phase and in the long term. This requires businesses to conduct regular audits, maintain continuous monitoring, and stay up to date on security updates as new threats emerge.

Security and compliance are critical subjects that require in-depth research and analysis before making the transition from your current legacy accounting software to a cloud-based solution.

Moving from legacy to cloud financial management software represents an important milestone in any organisation’s growth. The transition might seem overwhelming, but a well-laid-out approach makes this experience both manageable and rewarding.

A full picture and careful execution of each migration step determines your success. It is worth mentioning that stakeholder support and complete training drive smooth adoption throughout your organisation.

Your migration strategy must comprise strategies to protect data security, keep operations running, and meet compliance requirements. Begin with small steps, learn from your initial pilot project, and expand steadily. This systematic approach helps your team build confidence and keeps financial operations secure and efficient during the transition.

Are you researching a potential “candidate” for your next financial management upgrade? Check out Infor SunSystems Cloud and learn all you need to know about this robust solution via this 7-in-1 information kit! Download it today!