Circular99/2025/TT-BTC signifies Vietnam’s major effort in updating its Vietnamese Accounting Standards (VAS) and bringing them closer to International Financial Reporting Standards (IFRS). This regulatory shift is not just another mandate for compliance but a strategic opportunity for businesses to enhance their management, internal control frameworks, and beyond.

Read more:Vietnam’s Journey to IFRS: What Financial Leaders Need to Know

Key highlights of Circular 99/2025/TT-BTC

Circular 99/2025/TT-BTC (issued on October 27, 2025) by the Ministry of Finance is scheduled to officially supersede the existing Circular 200/2014/TT-BTC, which guides organisations on accounting vouchers, accounts, ledger keeping, and the preparation and presentation of financial statements.

This new Circular will become effective on January 1, 2026, and will apply to financial years commencing on or after this date.

Circular 99/2025/TT-BTC principles ensure that the financial statements of businesses accurately and comprehensively reflect the financial position while also enhancing the autonomy of organisations in structuring their internal accounting systems.

Circular 99/2025/TT-BTC incorporates several improvements compared to Circular 200, notably emphasising the importance of governance.

1. Scope & Flexibility in reporting

– Scope: Circular 99/2025/TT-BTC applies to all businesses regardless of industry.

– Statement of Financial Position: The term “Balance Sheet” is officially replaced by the “Statement of Financial Position” (Báo cáo Tình hình Tài chính).

– Non-mandatory separate Financial Statements: Head offices and affiliated units are no longer required to prepare separate financial statements (unless otherwise mandated by law). Instead, enterprises are responsible for aggregating financial information and fully eliminating all intercompany transactions.

– System update: Chart of accounts and accounting ledger forms have been revised and reorganised, now comprising 42 ledger forms.

2. Enhanced autonomy & Internal control

Enhanced autonomy and control are the most notable highlights of Circular 99/2025/TT-BTC, aiming to reduce the burden on Accounting – Finance functions:

– Self-developed internal governance regulations: Organisations are empowered to establish their own internal governance regulations and systems with clearly defined authorities and responsibilities related to transactions.

– Tailored ledger forms: Businesses are permitted to develop and design templates for accounting vouchers and accounting books to align with the business’ unique demands.

– Flexible internal revenue recognition: Businesses have the autonomy to decide whether their affiliated units recognise revenue when circulating internal products and services, irrespective of the type of voucher utilised.

– Simplify voucher authorisation: The Circular eliminates lengthy, rigid regulations (regarding ink type, writing method) and adheres to the general provisions of the Law on Accounting.

3. New regulations on accounting currency

Circular 99/2025/TT-BTC allows organisations to select a foreign currency as their accounting currency, provided they meet the conditions under Article 31 and their main collections and payments are in that currency.

– Exchange rate flexibility: Organisations are allowed to use the average transfer buying/ selling exchange rate or an approximate exchange rate

– Statutory financial statements: Despite being given the option to record transactions in a foreign currency, the statutory financial statements publicised and submitted to the Vietnamese authorities must still be presented in Vietnamese Dong (VND).

4. Requirements for accounting software

Article 28 of Circular 99/2025/TT-BTC underscores the role of technology and encourages the use of accounting software, subject to strict requirements:

– Compliance and accuracy: The software must conform to accounting and tax legislation; it must not alter nature, principles, accounting methods, or data.

– Change history: Any modifications must be tracked and logged with an audit trail, chronologically recorded.

– Security and alert mechanism: The software must ensure data security, incorporating an alert mechanism to detect unauthorised interference.

– Connectivity and updates: The software must be capable of integration with other systems (such as e-invoicing platforms) and allow for rapid adjustment and upgrading in response to legislative changes.

For more information on the new Circular, check out our resource page!

TRG is ready to help!

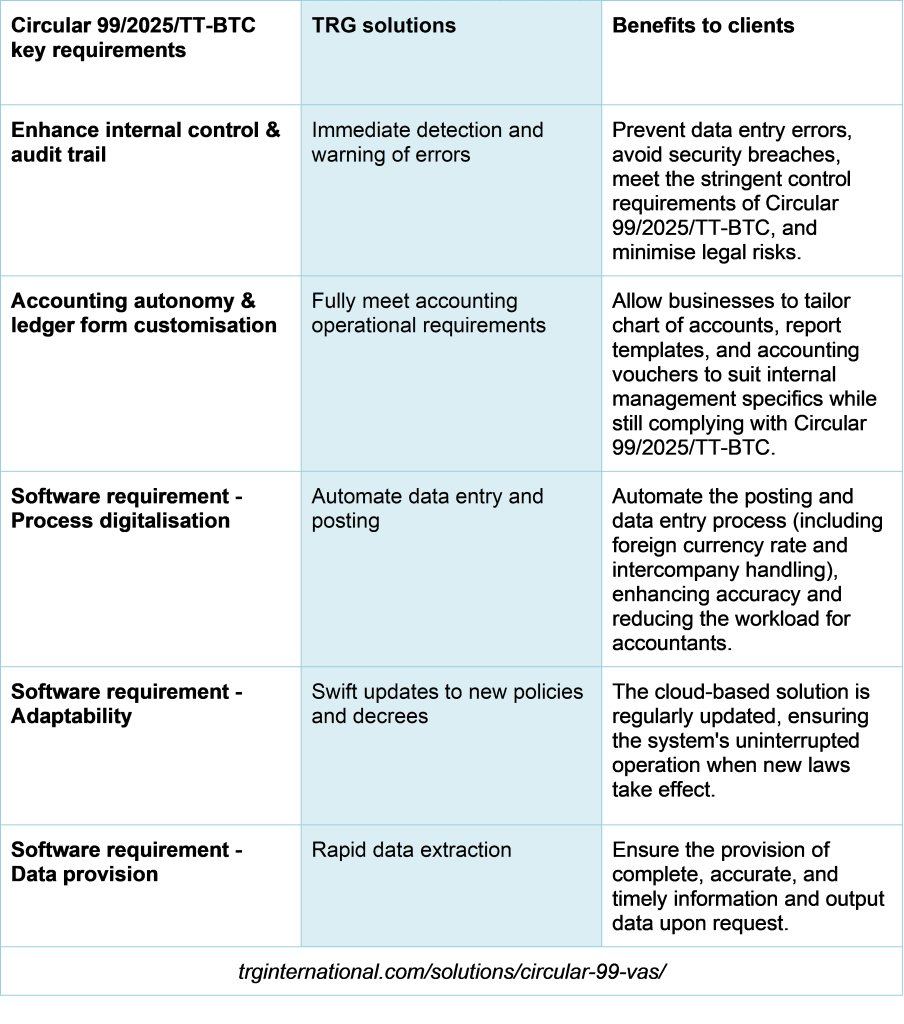

The transition to Circular 99/2025/TT-BTC necessitates a shift in management mindset, operational processes, and eventually, technology. TRG International provides cloud-based, industry-specific Financial Management solutions to empower businesses to fully capitalise on the advantages introduced by the new Circular.

– Our team is already getting up to speed on the new regulation changes, ensuring our consulting and technical teams are at the forefront of knowledge, ready to seamlessly implement and support clients through this transition.

– Our solutions are flexible to meet the changing compliance demands, ensuring Finance teams and businesses with real-time, accurate, and compliant financial details that meet not only local requirements but also international standards.

TRG solutions are compliant with Circular 99/2025/TT-BTC

Act now!

Circular 99/2025/TT-BTC presents a strategic opportunity for the Accounting and Finance departments to assert their strategic position.

Interested in knowing more?

– How can TRG help your business optimise your accounting system to comply with the requirements of Circular 99/2025/TT-BTC?

– What are the associated costs to transition to Circular 99/2025/TT-BTC?

– What is the typical implementation process for TRG’s solutions?

Ensure absolute compliance with regulatory changes starting 01/01/2026 and capitalise on new autonomy.