For many renewable energy companies, the numbers look reassuring at first glance. Contracts are signed, project pipelines stay busy, and long-term returns appear promising. But behind that surface, cash flow often feels much tighter than expected.

This is not because the business is failing, but because cash is tied up at the wrong moments in the project lifecycle.

Read more:Future-Proofing Financial Management in Renewable Energy Organisations

Tight cash flow: The daily reality of renewable energy businesses

Renewable energy projects demand heavy upfront investment. Long before any money comes back in, companies must:

- Commit cash to equipment

- Mobilise contractors

- Complete engineering work

What comes in later depends on:

- Milestone approvals

- Regulatory signoffs

- Grid connections

- Other third-party decisions

All of these are entirely outside the company’s control. In other words, expenditures incurred before billing eligibility and receivables held up by approvals or disputes. As a result, cash accumulates within active projects rather than returning to circulation.

This concept is best explained by the Cash Conversion Cycle (CCC), which measures the time during which operating cash remains unavailable after it is spent. A lengthening cycle signals that liquidity is being consumed faster than it is replenished. Without intervention, stretched CCCs force companies to rely on external funding or limit growth, even while order books remain full.

Read more:Poor Cash Flow, Overdue Payments Thwart Your Accounts Receivable Processes?

The risk intensifies as the business and their operations scale. Each additional project increases the amount of capital locked into work in progress, while collections remain staggered and conditional.

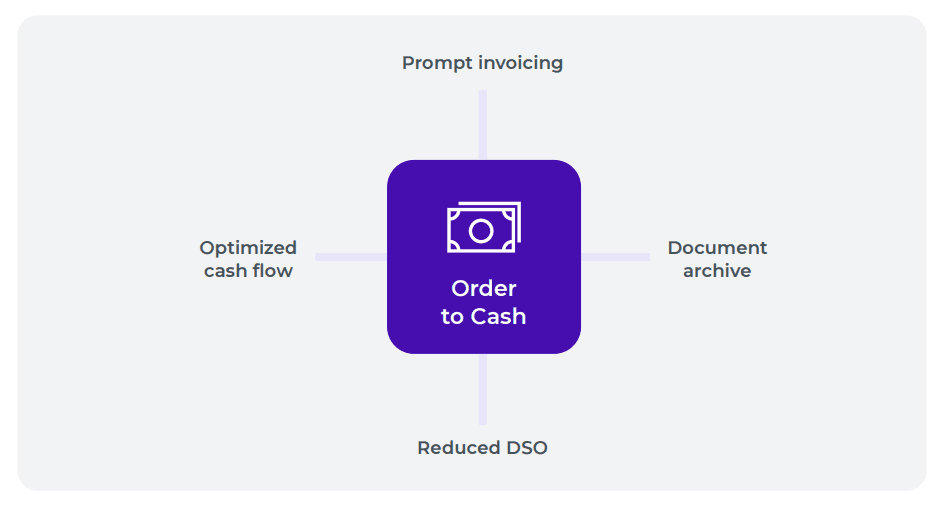

The CCC does not exist in isolation. It is directly shaped by how effectively theOrder-to-Cash (O2C) process is managed.Order-to-Cash covers everything from billing project milestones to collecting customer payments.

In renewable energy projects, this relationship is especially critical. Billing often depends on progress validation, regulatory sign-offs, or third-party inspections. Without clear visibility into what has been billed, what is pending approval, and what is overdue, finance teams only discover cash flow issues once they begin affecting project execution or supplier relationships.

This is why managing cash flow is not just about monitoring costs or revenue. It requires tight control over the entire Order-to-Cash process and real-time insight into how project activity translates into actual cash.

Achieving smarter cash flow control for renewable energy businesses with Infor SunSystems Cloud

Infor SunSystems Cloud is designed to help renewable energy companies regain control of cash flow by strengthening visibility across the Order-to-Cash process. By connecting billing, receivables, and financial data in real time, it shows how project activity converts into cash as it happens, not weeks later.

Read more:Struggling with Fixed Asset Management? SunSystems May Be the Answer

How Infor SunSystems Cloud streamlines the Order-to-Cash process for renewable energy businesses

For project-based businesses, SunSystems supports:

- Detailed tracking of staged invoices

- Milestone billing

- Outstanding receivables

Finance teams can clearly see what has been billed, what remains unpaid, and what cash is realistically expected to be collected, allowing issues to be addressed early before liquidity tightens.

Automation plays a key role. Transactions are posted and reconciled as they occur, keeping financial data accurate throughout the Order-to-Cash cycle and reducing dependence on spreadsheets or manual workarounds. As a result, forecasts become more reliable, CCC becomes more predictable, and cash flow management shifts from reactive to proactive.

Need help ensuring your financial reports give you clear insight into cash flow challenges, highlight where cash is getting stuck, and help you make sense of the data you already have? Share your concerns with us!