Corporate reporting is evolving at breakneck speed, with ESG metrics now a near-universal expectation. Yes, environmental, sustainable, and governance factors are making a grand entrance into business reporting worldwide. A whopping 95% of the world’s largest companies (G250) are now disclosing their ESG metrics.

In this article, we will attempt to scratch the surface of ESG reporting as we hope to explore the topic deeper in the future. We will also explore the critical role of accountants in not just meeting these demands but transforming ESG reporting into a streamlined, strategic advantage.

Read more: What Are CSR, ESG, and Sustainability & Why Do They Matter for Businesses?

What is ESG reporting?

Environmental, social, and governance (ESG) represents a fundamental move in corporate reporting, enabling stakeholders to grasp the effects of business activities on the environment and society. The reports measure and disclose each factor and its impact on the business.

The shift is necessary to meet the demands of global regulations and increase customer needs. Insights from ESG reports can be used to communicate a company’s commitment to sustainability and responsible business practices to stakeholders.

ESG reporting has grown from a simple regulatory requirement into a strategic necessity. Organisations now recognise its value for attracting investors, promoting trust, and reducing risks.

Read more:IFRS 17’s Impacts on Insurers: A Comprehensive Analysis

Key components of ESG reporting

ESG reporting has 3 core components:

- Environmental metrics: Carbon emissions, climate change effects, pollution, waste disposal, and resource depletion

- Social factors: Supply chain management, discrimination policies, diversity initiatives, human rights, and community relations

- Governance elements: Executive compensation, shareholders’ rights, board elections, and independent directors

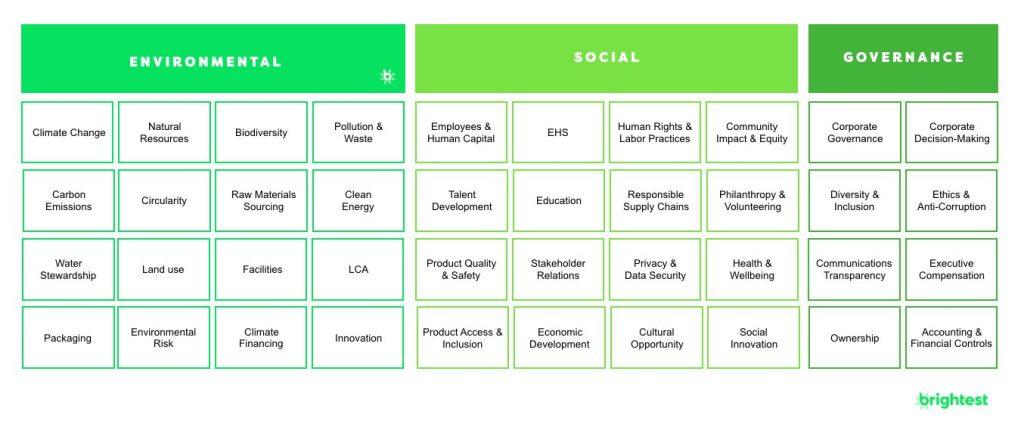

The report aims to address business-related topics and themes relating to:

Source: brightest.io

A “special task force”, such as a dedicated ESG team or investor relations or corporate affairs department, is responsible for publishing businesses’ ESG reports. The reports are a collective effort from different functions within the company.

ESG reports are now mandatory in the United States, Canada, the European Union, the United Kingdom, and Singapore. Other regions are striving to mandate stricter regulations on businesses, particularly publicly listed companies.

Read more:Why Sustainability Is Important in Hospitality and the Best Practices

Double materiality

ESG reporting introduces the concept of ‘double materiality’, which is required under the Corporate Sustainability Reporting Directive (CSRD), the new EU directive for reporting non-financial information.

According to PwC, “Double materiality refers to the fact that companies reporting on sustainability must consider the relevance of a sustainability matter from two perspectives.”

The two perspectives are:

- How much of an impact the businesses have on people and the environment, and

- How much risk and opportunity do sustainability-related developments and events bring to the businesses

Businesses will self-evaluate whether their subject is material or not. Each region’s regulations will have guidelines for determining which subject or topic is material.

Read more: How to Implement a Continuous Governance, Risk, and Compliance Program

The strategic role of accountants in ESG reporting

Accountants have unique skills that make them vital drivers of ESG initiatives. Their analytical mindset and expertise in process management are valuable assets in today’s changing world of business reporting.

Their expertise stands out in:

- Process analysis and internal controls design

- Data quality management and verification

- Objective evaluation of reported information

- Risk assessment and mitigation strategies

- Standards-based analytical approaches

Read more: The Need for Industry-specific On-demand Training for End Users

They serve as strategic allies to executive teams and share practical views on tapping into financial value through ESG investments. Their work goes beyond just reporting:

- Accountants can effectively identify relevant ESG data points to track while helping establish robust data collection processes to ensure quality and accuracy.

- Accounts can help align the business’ ESG reports with relevant standards, ensuring compliance as they are already familiar with various financial reporting frameworks and standards (e.g., GAAP, IFRS, USALI, etc.)

- With their strong background in auditing, accountants are already well-equipped to provide independent verification of ESG disclosures

- Accounts can analyse the financial effects of ESG factors and incorporate them into planning and forecasting, thus providing leaders with insights into ESG initiative performance while advising them of potential risks/ opportunities

As the demands for ESG reporting grow, accountants are poised to play a leading role in shaping the future of corporate accountability and sustainability.

Financial benefits of ESG integration

Research shows the correlations between ESG practices and business value creation; investing in ESG does not compromise returns but rather the opposite.

According to a McKinsey study, there are five key links between ESG and cash flow:

- Facilitate top-line growth

- Reduce costs

- Minimise regulatory and legal interventions

- Increase employee productivity

- Optimise investment and capital expenditures

These factors can help guide business leaders in their endeavours towards a more sustainable future.

Internal audit teams are a fantastic way to get ESG reporting efforts moving. Organisations can build a strong framework for sustainable value creation by setting up regular data collection processes that coincide with financial reporting cycles.

Incorporating ESG factors into the business’ accounting processes

ESG accounting systems need a step-by-step approach focuses on data integrity, reliable controls, and consistent reporting processes. The lifeblood of effective ESG reporting systems lies in leadership’s steadfast dedication to act with integrity.

Setting up data collection processes

Reliable ESG reporting depends on complete data collection mechanisms. A pre-readiness assessment helps organisations learn about applicable regulations and reporting requirements. Proper assessments will help businesses:

- Identify data sources and collection points

- Develop consistent collection procedures

- Implement technology solutions for data management

- Create documentation guidelines

- Establish validation protocols

Collecting reliable data is the key to building trust in sustainability reporting. ESG initiatives are a cross-functional effort. Teams must work together to develop appropriate structures and responsibilities. Organisations must evaluate their current processes to handle diverse data types, from quantitative metrics to qualitative assessments.

Establishing internal controls

ESG reporting’s internal controls should match the rigours of financial reporting systems. The control guidelines should cover:

- Clear roles and responsibilities: Clearly define who is responsible for collecting, validating, and reporting ESG data plus establish a chain of command and accountability.

- Data quality standards: Define metrics, data sources, and validation procedures to ensure consistency and accuracy.

- Documented procedures: Develop detailed written procedures for all aspects of ESG reporting.

- Change management: Establish a process for managing changes to ESG reporting procedures, data sources, or metrics.

- Regular reviews and approvals: Establish regular review and approval processes at various reporting stages to ensure accuracy and completeness.

- Training: Train employees on ESG reporting procedures, data quality standards, and the importance of accurate reporting.

- Communication: Set up communication channels to ensure all stakeholders stay informed about changes and updates.

- Monitor and evaluate: Regularly monitor the effectiveness of internal controls for ESG reporting and identify areas for improvement.

A robust internal control system not only enhances the business reputation but also contributes to better decision-making and improved ESG performance.

Regular assessments by internal audit teams help identify gaps, weaknesses, or inconsistencies in ESG reporting practices. Companies must implement verification processes to ensure data integrity throughout the collection and reporting cycle.

Creating reporting frameworks

Reporting frameworks require careful evaluation of various standards and stakeholder requirements. Companies must ensure their reporting frameworks allow for:

- Integration with management reporting systems

- Alignment with financial reporting cycles

- Compliance with relevant standards

- Adaptability to evolving requirements

The process must include checks for consistency and comparability while controls protect against manipulation or errors. Additionally, the reporting framework should be flexible enough to accommodate changes in global reporting standards.

Innovative technology solutions serve a vital role in framework implementation. Automated tools help standardise sustainability processes, resulting in improved efficiency, integrity, traceability, and confidence in sustainability decision-making through better data management and analysis capabilities.

Technology solutions for ESG accounting

Modern technology can help elevate new yet complex challenges associated with ESG accounting and reporting. Organisations can and should take advantage of specialised software instead of traditional spreadsheets to streamline their ESG reporting processes.

Data management platforms

Cloud-based data management platforms and solutions like data lakes can help address complex data issues. These systems provide centralised data repositories across organisations. Data lakes can store an endless amount of information, both structured and unstructured, regardless of where the data comes from or its format.

These tools break down silos and bring a unified, single source of truth for not just ESG but company-wide reporting.

Modern software includes features for automated data collection and live updates, as well as scalability and mobile-optimised dashboards that users can access anywhere and scale the platform as demand changes.

Read more: Tech Tidbits: What is Software-as-a-Service (SaaS)?

Automation

Automated ESG data collection and reporting processes cut down manual effort and improve accuracy. These automated systems can gather data from disparate sources, from financial management systems, ERP platforms, or Marketing channels to external databases. Organisations can maintain consistent data quality and reduce human errors in reporting processes with these solutions.

Artificial intelligence has changed ESG data management by boosting the speed and precision of data analysis. AI algorithms analyse large datasets to identify patterns, anomalies, and potential risks with high levels of accuracy. This technology makes predictive analytics possible, which helps organisations anticipate potential risks and trends based on historical data.

Read more: You’re Losing Money on Manual Invoice Processing! Here’s A Solution

Data analytics and visualisation

Advanced analytics capabilities play a key role in extracting meaningful insights from ESG data. These tools process large volumes of information to uncover trends and patterns that manual analysis might miss.

Data analytics helps organisations monitor performance against sustainability goals with greater precision. Companies can track their progress and adjust their strategies when needed.

Data visualisation tools have changed how organisations share their ESG performance with stakeholders. Interactive dashboards and visual reports make complex sustainability information easier to understand. Organisations can represent ESG data in an attractive or easy-to-understand way for stakeholder exploration.

Read more: How Data Analytics Makes Life Easier for C-level Executives

Conclusion

Despite ESG reporting still being in the voluntary phase in various regions, the future belongs to organisations that build an ESG-ready culture and embrace tech solutions.

Many companies see ESG as more than just compliance; it adds strategic value in building long-term growth and stakeholder trust.

Finance professionals play the leading role in making businesses more ESG reporting-ready due to their analytical expertise and experience with different regulation frameworks.

How do you prepare your organisation for what’s to come?